Overview of the Everest Strategy

The Everest Strategy’s goal is to keep the best stocks computed by the Everest Formula in the portfolio. Once a week, the strategy checks and (if needed) updates the stocks in the portfolio, replacing stocks that exited from the first positions with the new stocks that entered it.

Why weekly and not daily, monthly or yearly? Because backtests have shown that updating your portfolio on a weekly basis is the best trade-off for catching the chances that the market offers at the right moment without sacrificing time and money for commissions.

How to choose between 3, 5, 10, 20… stocks to own? Generally speaking, an investment portfolio that uses more stocks offers less volatility but tends to align the results to the market, whereas using fewer stocks provides better performance (if the strategy is good) but can bring more volatility and periods with negative returns. The Everest Strategy backtests suggest keeping the stock number between 3 and 10.

Applying the Everest Strategy – 10 Stocks

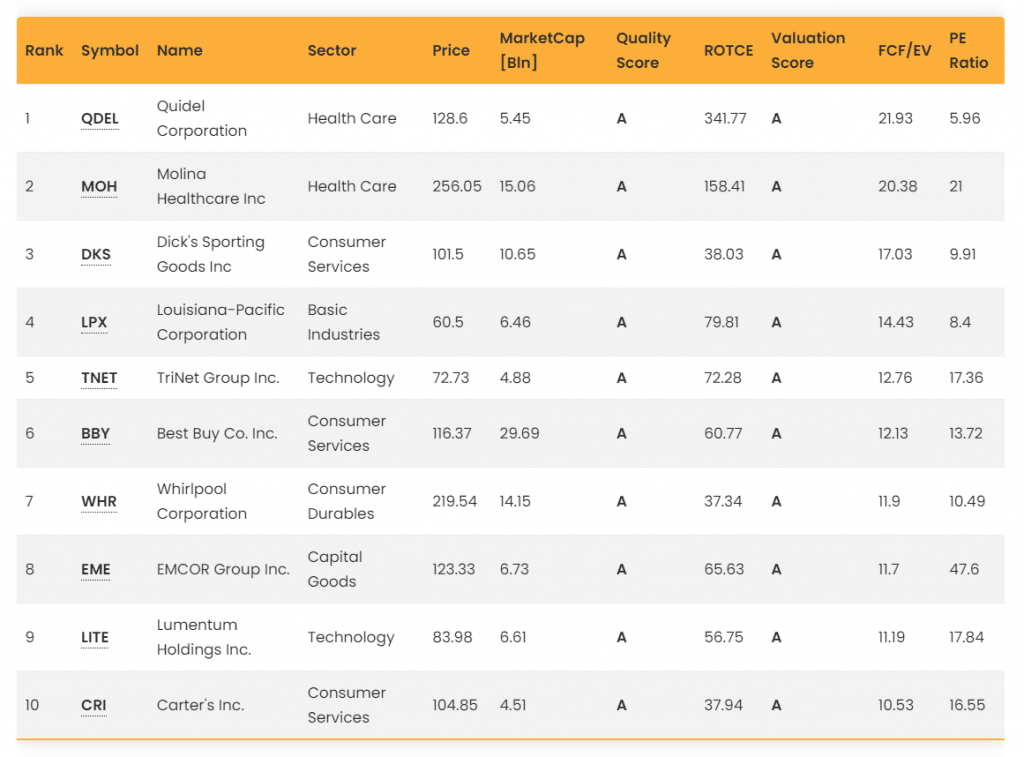

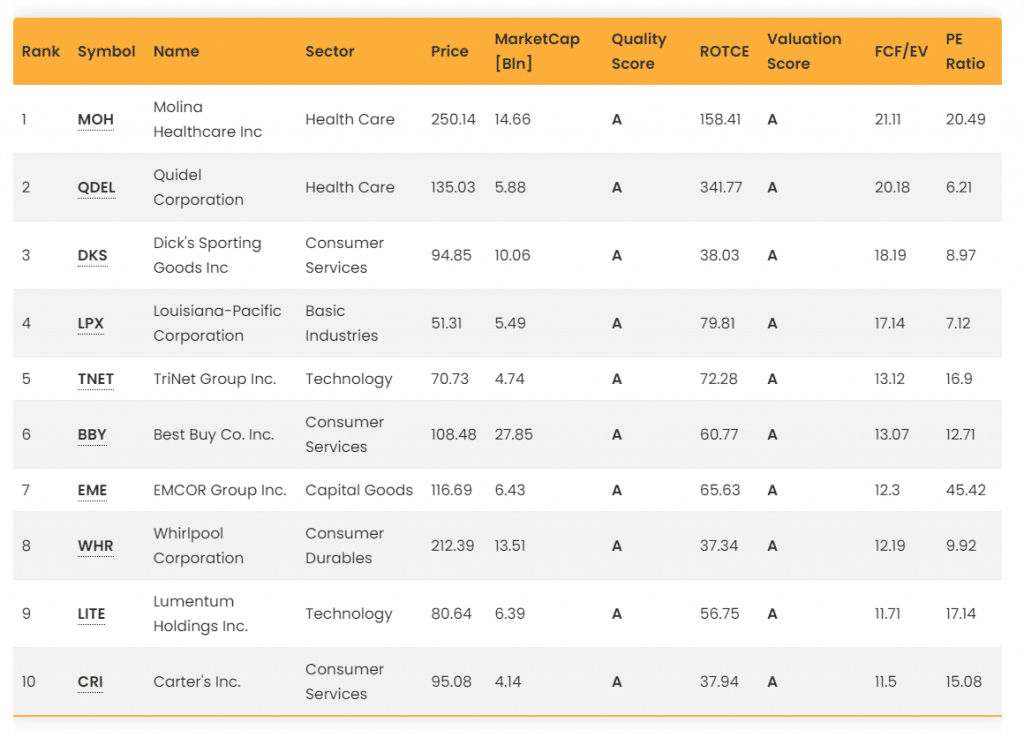

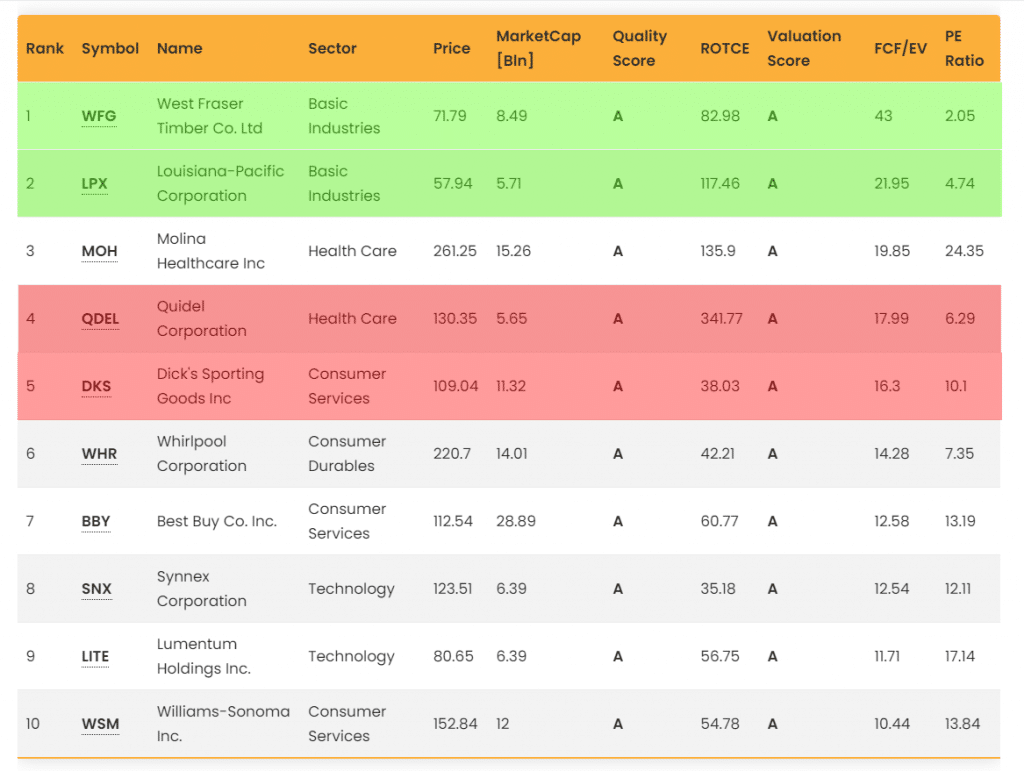

Suppose we subscribed to the Everest Formula on July 1, 2021, and have 10k dollars that we want to invest. We chose to buy ten stocks for our portfolio because we want to balance the performance with contained volatility for our risk tolerance. Opening the Everest Screener on that day, we would see the following companies:

We must split our 10k dollars among the first ten stocks, buying approximately $ 1,000 of each company’s shares with our broker. Here is our portfolio situation after the purchases:

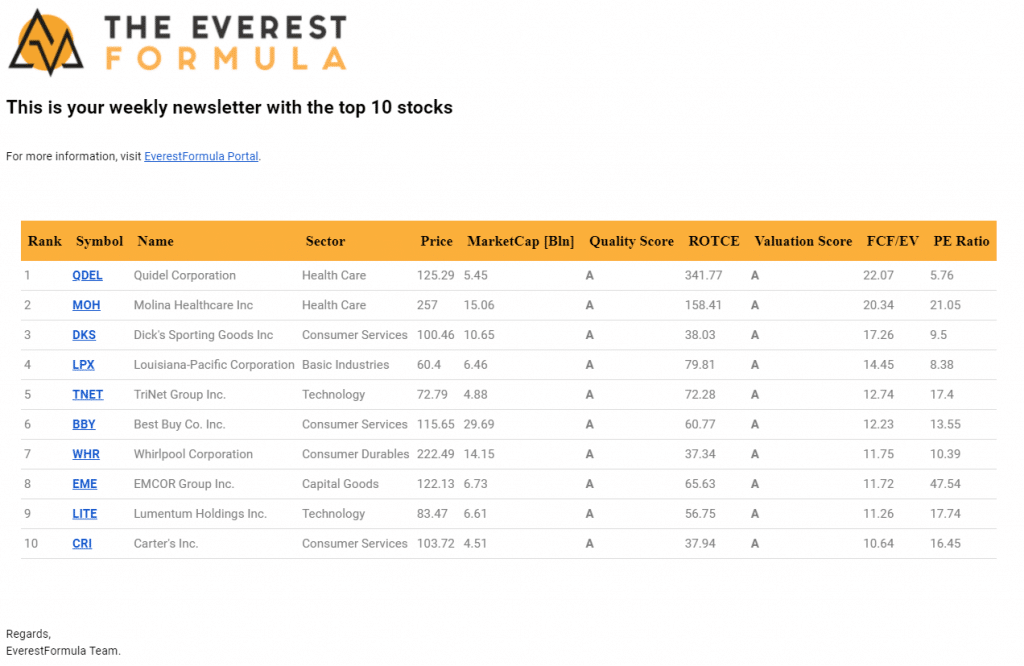

We don’t want to check the screener every week. Hence we set to receive the newsletter with the top 10 stocks every Monday via email. We can do it on the profile page.

Following Monday (July 5), we receive an email with the following stocks:

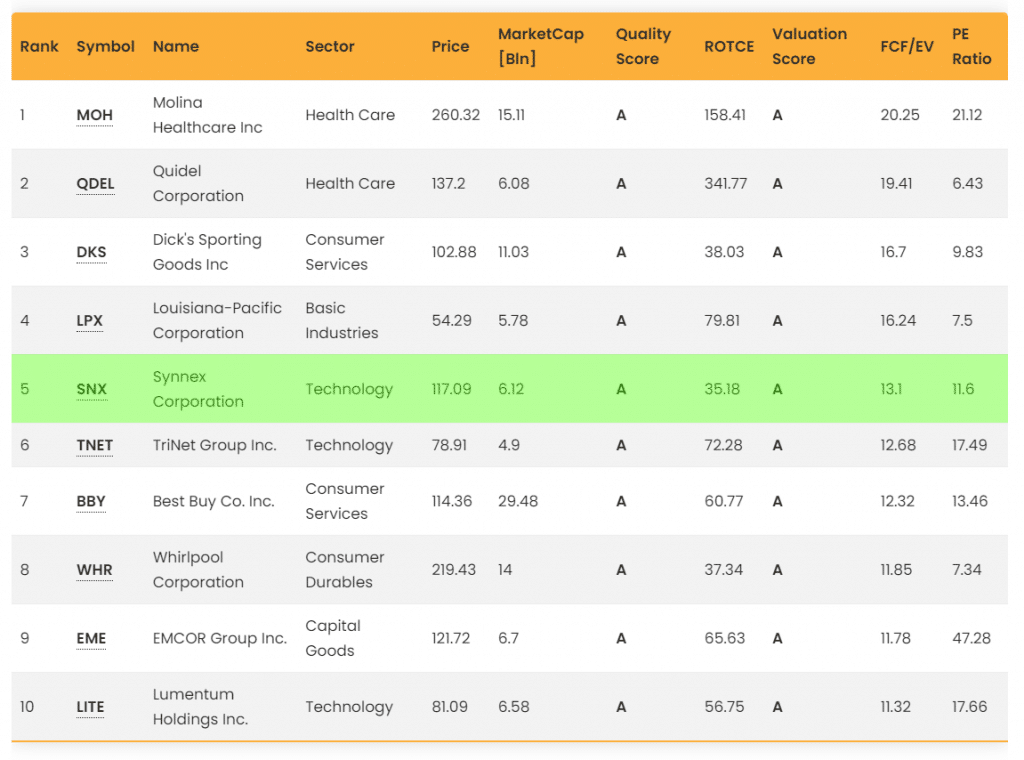

Nothing has changed in the top 10 stocks, so we don’t need to change anything in our portfolio. The same happens on July 12. On July 19, we received a new mail with the updated ranking:

Here are some variations: MOH overcame QDEL to the 1st position, and the same happened between EME and WHR. But we don’t need to make any changes in our portfolio because we decided to own ten stocks, and within the first ten stocks, we don’t care about internal position exchanges. NOTE: Only if we had decided to keep a portfolio of 7 stocks we would have sold WHR and bought EME.

The following Monday (July 26), the situation changes again, and a new stock enters the top 10 list:

We need to buy SNX and sell CRI that came out from the list. We also take advantage of the trades to rebalance the portfolio to have our money equally distributed among the ten stocks again. This step is optional but can help to keep your portfolio well diversified and to take advantage of the stocks that have become more undervalued from the last transactions.

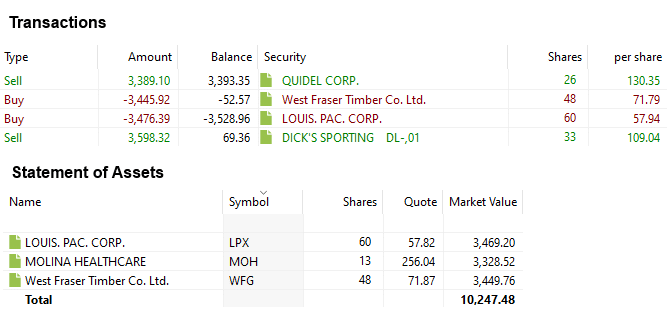

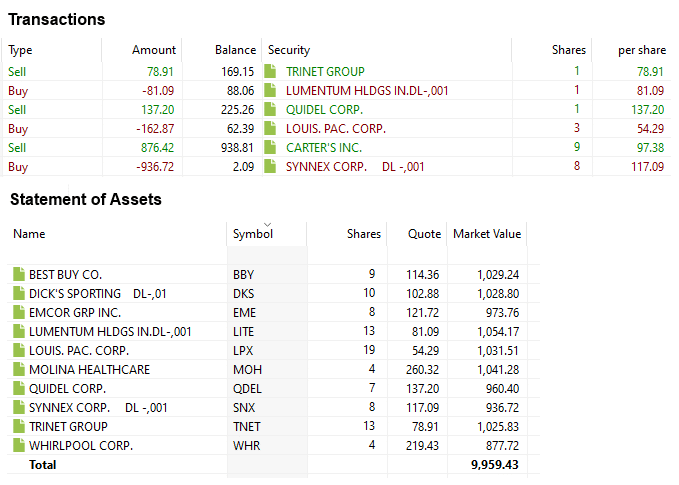

The image below shows a recap of the transactions to purchase SNX, sell CRI, and rebalance the portfolio:

We notice that from July 1 until the 26th of the same month, the market value of our portfolio remained roughly the same. That is possible: The Everest Strategy is not intended for short-term gains. Looking at the backtests, there are some months in which the Formula produced flat or negative results. But in the long run, it has produced impressive results. For this reason, it is crucial to keep the strategy for one or more years to appreciate its effectiveness.

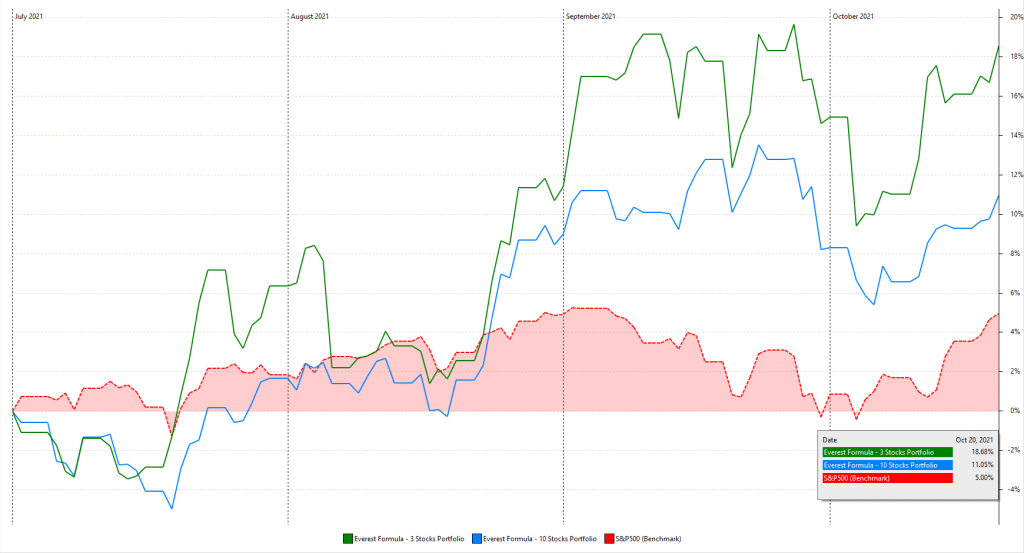

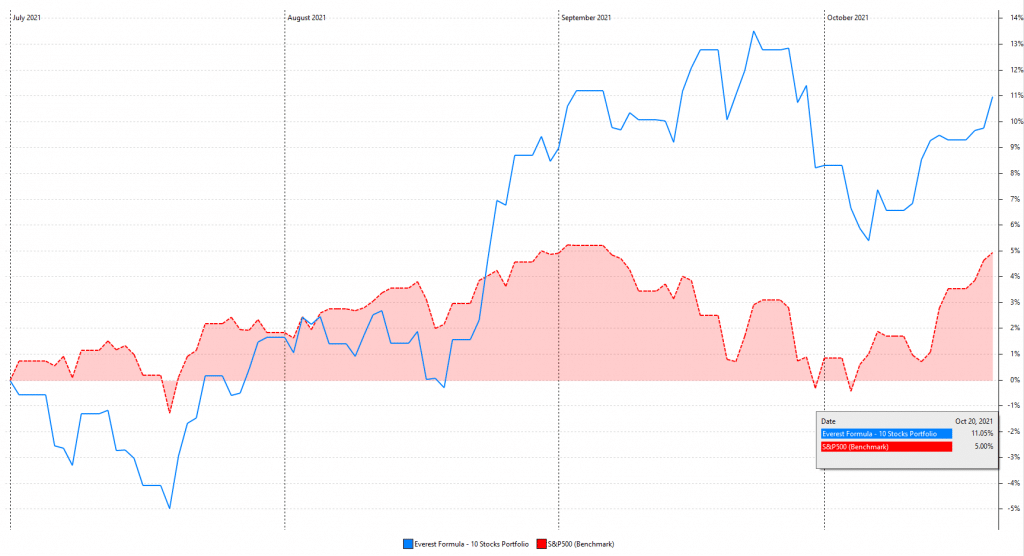

Indeed, continuing with the weekly checks and updates described till now, the strategy started collecting some gains from August’s end. Until October 20, it returned about 11%, compared to the 5% of the S&P500 in the same timeframe.

Applying the Everest Strategy – 3 Stocks

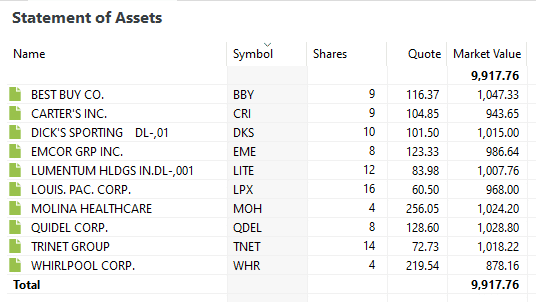

Like in the previous chapter, we imagine being investors that subscribe to the Everest Formula on July 1, 2021, and have 10k dollars to invest in it. Now we choose to buy only three stocks because we don’t care about volatility and want to maximize the performance of our portfolio. Here’s a recap of the top 10 stocks on July 1, 2021:

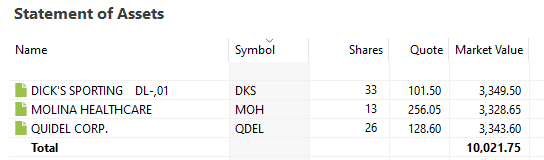

We split out our $ 10,000 among the first three stocks, buying approximately $3,300 of QDEL, MOH, and DKS in our broker. Here’s our portfolio situation after the purchases:

Using the same process explained for the ten stocks strategy, we receive the top 10 stocks through the newsletter every Monday. Alternatively, we can check it personally through the Everest Screener and update the portfolio only if something changes in the first three positions of the rank. This won’t happen until August 9, when WFG and LPX will have replaced QDEL and DKS in the first three positions:

The image below shows the transactions made on August 9:

Continuing with the weekly checks and updates described till now, the strategy with three stocks from July 1 till October 20 returned about 18.7%, compared to the 5% of the S&P500 in the same timeframe.