- The Free Membership is conceived for people that want to get a taste of the Everest Formula platform and its capability. Despite its limited functionality, it can still be useful for value investors who are searching for the right investment.

- We are going to present two use cases in which free members can use the Everest Screener and the free daily Everest Analysis to find bargains on the market and avoid value traps.

Are you interested in using the free features described here? Join us for free!

Overview of the Free Membership features

The Free Membership consists of 3 features:

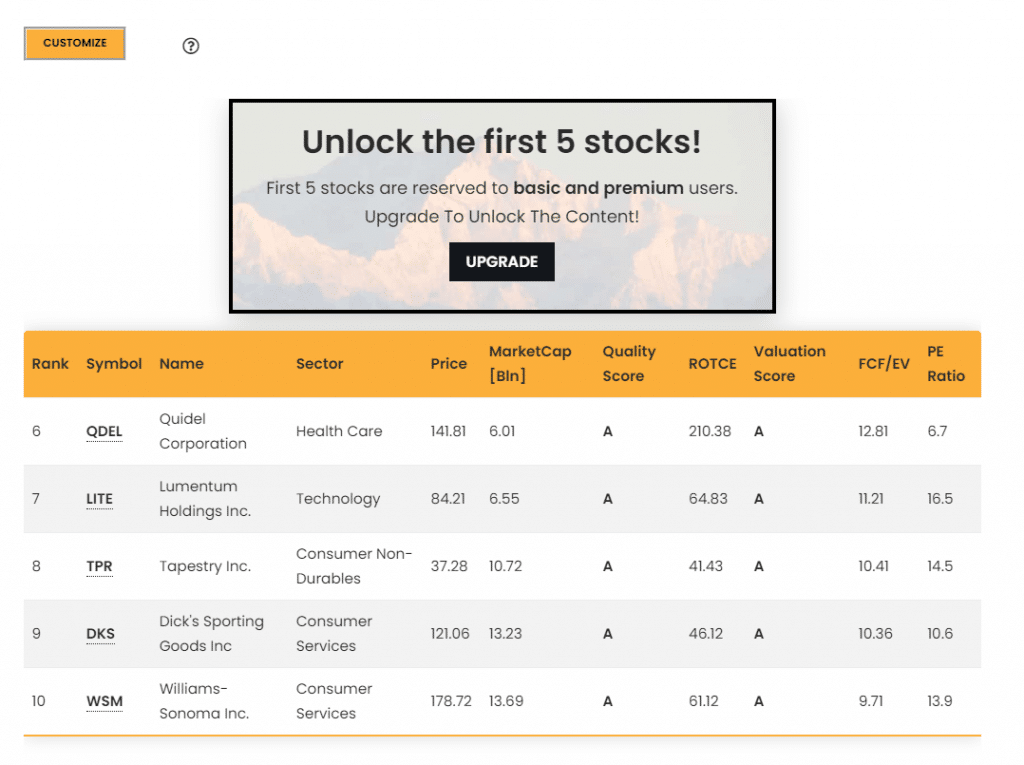

- Access to stocks ranked from 6th to 10th of the Everest Screener.

- Analysis of the stocks ranked from 6th to 10th, by clicking on their symbol in the Everest Screener table.

- Analysis of a company randomly selected by the platform, on the Everest Analyzer page. Everyday the platform selects a new company and shows its analysis for free.

We are going to show practical examples of how they can be used.

Finding bargains with the Everest Screener

Bob is a value investor who likes to make his own analysis using Warren Buffett’s 4 pillars of a good investment:

- Invest only in businesses you can understand

- Invest in companies that have an economic MOAT

- Invest in companies that have a good management team

- Invest in undervalued companies

Bob has subscribed to the Everest Formula to get some ideas about stocks to invest in. When he opens the Everest Screener today, he finds the following companies:

These companies seem all good and undervalued businesses, so he clicks on each of the symbols to understand what these companies does. When he clicks on TPR and reads the company overview, something catches his eye: TPR is the company that produces the Coach’s handbags and goods that he often gives to his wife as a Birthday and Christmas gift!

The business is quite straightforward: they make money selling apparel and accessories worldwide, through 3 brands: Coach, Kate Spade and Stuart Weitzman. Bob starts to look at some presentations and annual reports directly from the company investors website, and understands that it is a strong company that produces high-quality products and that is expanding worldwide.

Bob also knows that they have a strong brand moat: his wife, like other thousands people in the world, prefers Coach’s handbags because they like the Coach brand and the quality of all their products.

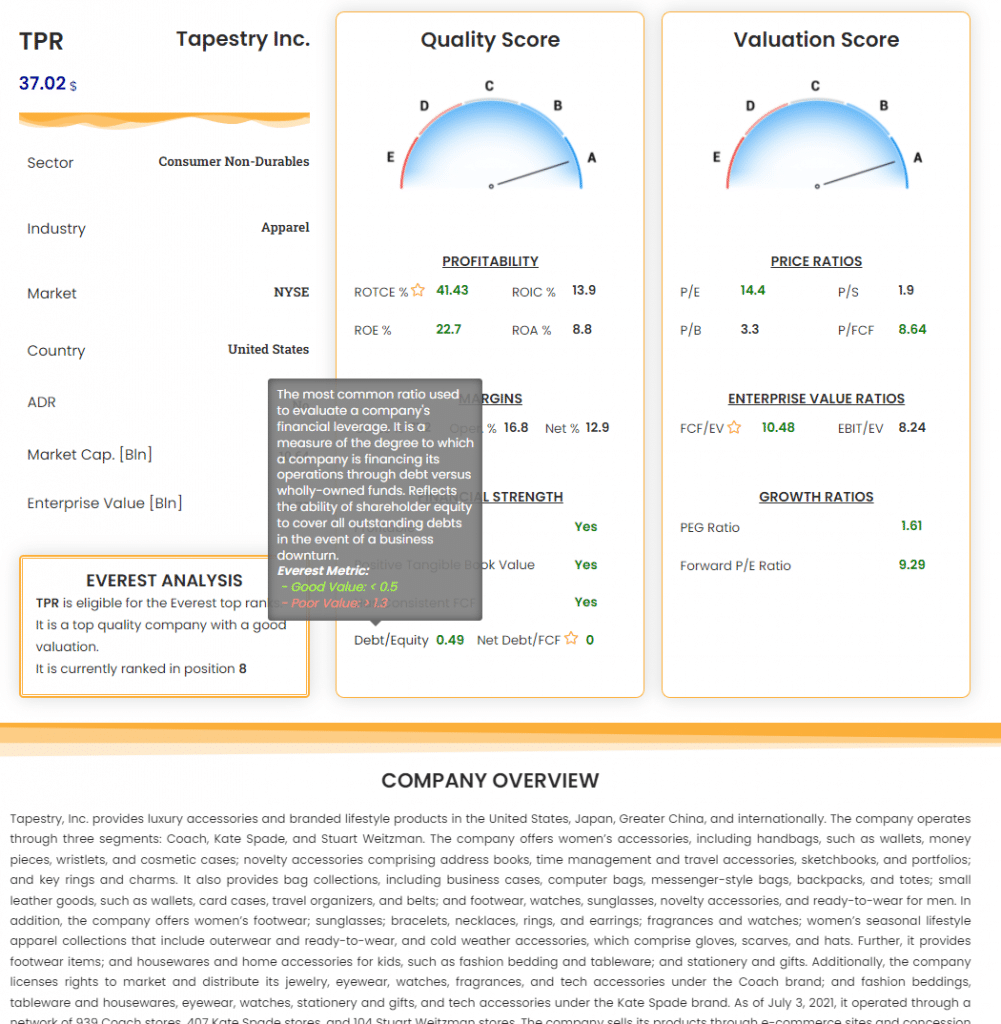

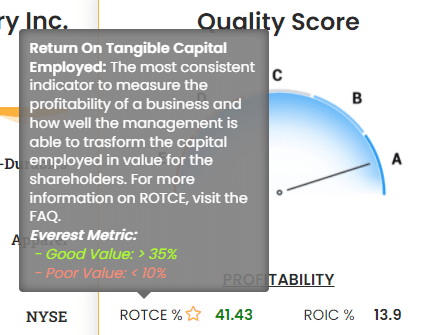

For the third principle (to have a good management team), he just takes a look at the Everest Analyzer, on the Quality Score section: the company is managed with a minimum amount of debt, and the management is also capable to allocate their assets very well, having a good ROIC and a very good ROTCE. He clicks on all the metrics proposed by the Everest Formula, using the tooltips that appears to better understand what their meaning is and what values are considered good for each metric.

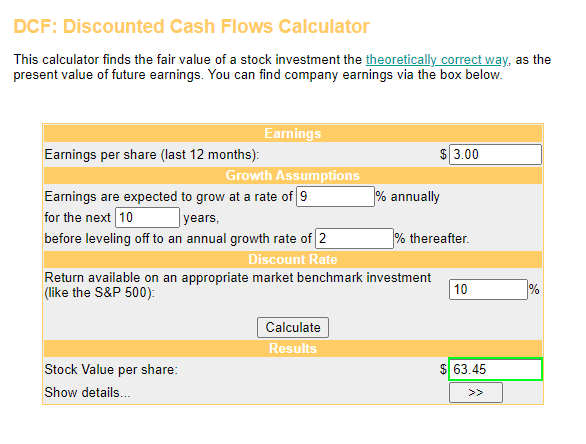

Lastly, he wants to understand its valuation: the Everest Analyzer Valuation Section comes in handy: all the valuation metrics look really good, and TPR price seems to underestimate its real value. But Bob want to go more in depth and use the Discounted Cash Flow model to make a precise valuation of the company: using one of the thousands free tools available on the web, he fills all the form fields using the last company financial report or a financial website that collects fundamental data, like Yahoo Finance.

He inserts 9% as the expected growth rate of the company (found in Yahoo analysis page. Even if analysts are usually wrong, Bob knows that it is a plausible value because he compares it with the historical growth rate of the company and the idea of the future perspectives that he built while looking at the reports and presentations), a 2% perpetual growth rate (a common conservative value) and a 10% discount rate (i.e. the average annual return that Bob requires for his investments). The output looks really good: with a value per share of 63.45$ and a current price of 37.02$, the stock seems currently about 40% undervalued.

Bob has just found the right stock for him!

Getting new ideas and avoiding value traps with the free daily analysis

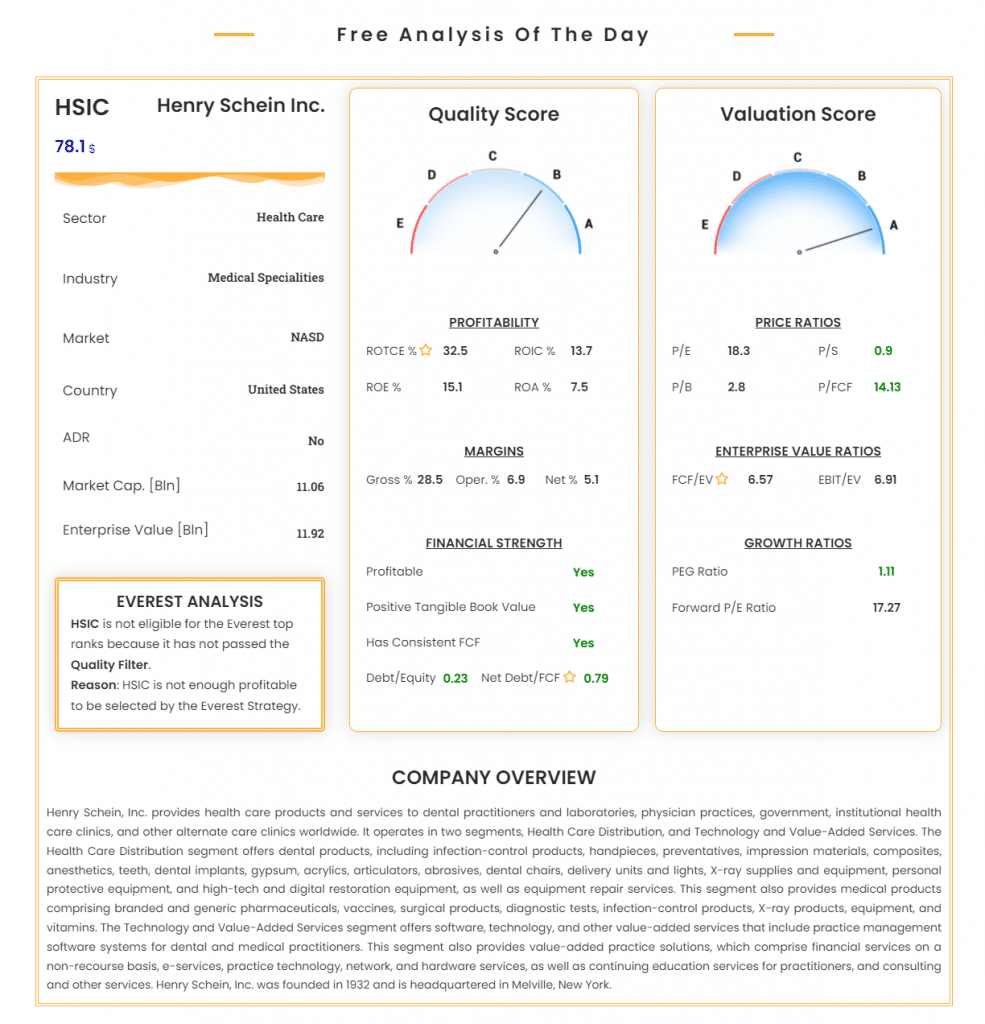

Alice is a young investor who likes to learn new analysis techniques and discover everyday new companies to invest in. She subscribed the Everest Formula to understand how a company can be valued, and everyday she opens the Everest Analyzer page to find out what the daily analysis is. Today we have HSIC stock:

HSIC seems to be not profitable enough to be selected by the Everest Formula as a top ranked stocks for the Everest Strategy. Anyway, HSIC has quite good profitability metrics, a very good financial position and looks really undervalued. The Quality and Valuation scores of respectively B and A point out that it is a really good stock that Alice will take in consideration for a deep dive, using the instruments to make a qualitative valuation, i.e. understanding the business and the potential future growth.

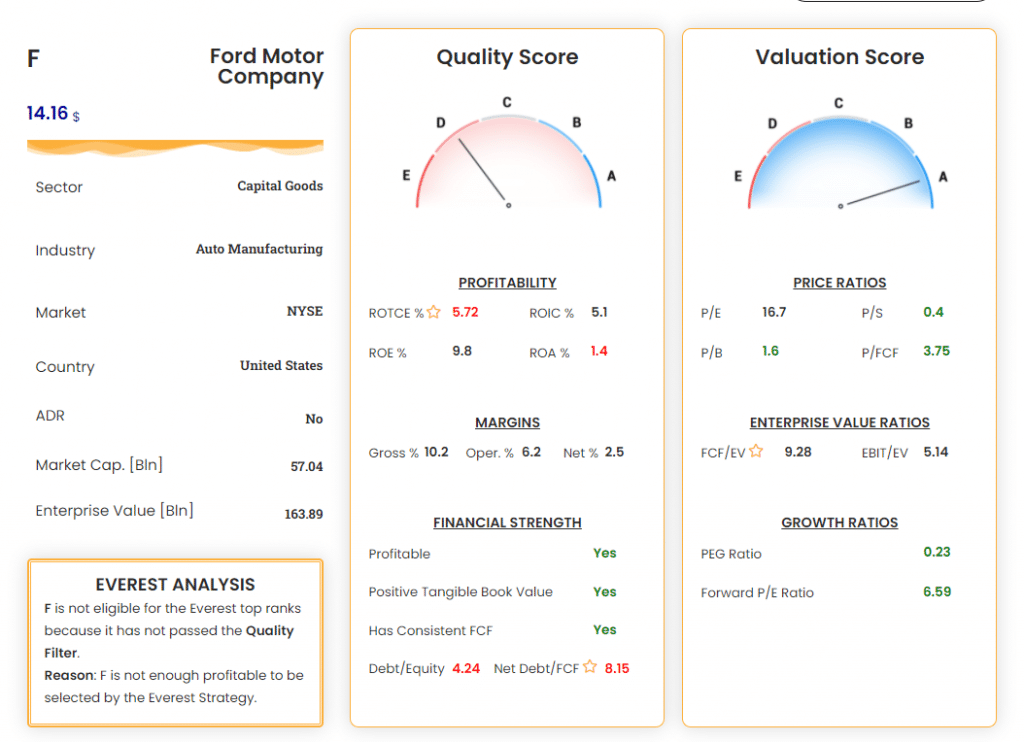

Next day Alice finds “Ford Motor Company”, a stock that she already heard of in a value investing reddit group, in which people commented the stock with sentences like “Ford is really undervalued, with a Price/Sales ratio of 0.4 and a forward PE ratio of just 7!”

Looking at the Analyzer, Alice realizes the harsh reality: Ford has a huge amount of debt, and generates too little profit for the assets it needs to maintain its business, due to the high competition of the Auto Manufacturing sector. While Ford seems to be a cheap stock, it is also a poor quality stock, making it not appealing for a value investor. Even if the stock price can go anywhere in the short term, it’s difficult to say that it is a good bargain for the long term.

Alice has realized that Ford is a value trap.

Conclusions

The Everest Free account is a good entry point to understand how the Everest Formula works and still pull out some stock ideas from it. However, Basic and Premium accounts are the real game changer for the value investor, by enabling the revolutionary Everest Strategy that has returned outstanding results both over the last 20 years and particularly in 2021. If you are interested in upgrading your free membership, take a look at the available options here.