- The Premium Membership helps intermediate and advanced users to find the best opportunities across the stock market, through the advanced filters of the Everest Screener and the Everest Analyzer.

- The Everest Screener Advanced Filters let you customize the ranking system of the Everest Formula, in order to find stock ideas within specific sectors and broaden/restrict your research to Small Cap/Big Cap companies.

- The Everest Analyzer creates a scoreboard of all the stocks available in the U.S. market, and lets you check the stocks you are interested in, both from a quality and a valuation perspective, in order to make the right decision as a value investor.

Are you interested in using the premium features described here? Join us!

Overview of the Premium Membership features

The Premium Membership still includes the free and basic features, like “apply the Everest Strategy” and “receive the weekly newsletter“, with the best stocks of the moment.

Furthermore, here’s a recap of the exclusive features reserved to premium users:

- Everest Screener Filters: Access to the top 50 ranked stocks, fully customizable ranking system to get the best stocks within specific sectors and capitalizations.

- Everest Analyzer: Full access to the Analysis of more than 6000 stocks, with quality and valuation scoreboard.

- Premium Support: Response within 1 working day.

We are going to make a deep dive on the first two features with practical and actual examples.

Advanced Filters of the Everest Screener

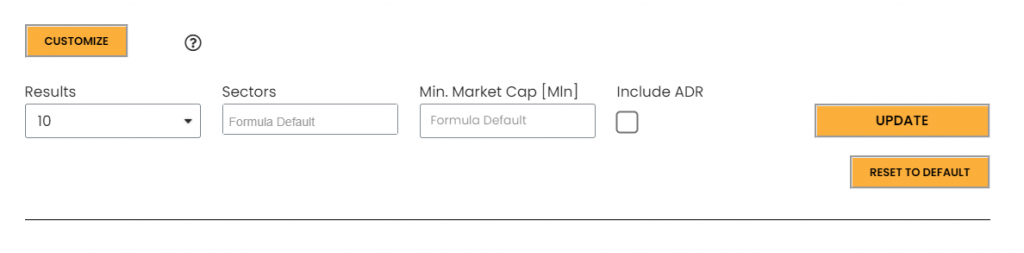

The “Customize” button lets you open the advanced filters section, where you can apply the following filters:

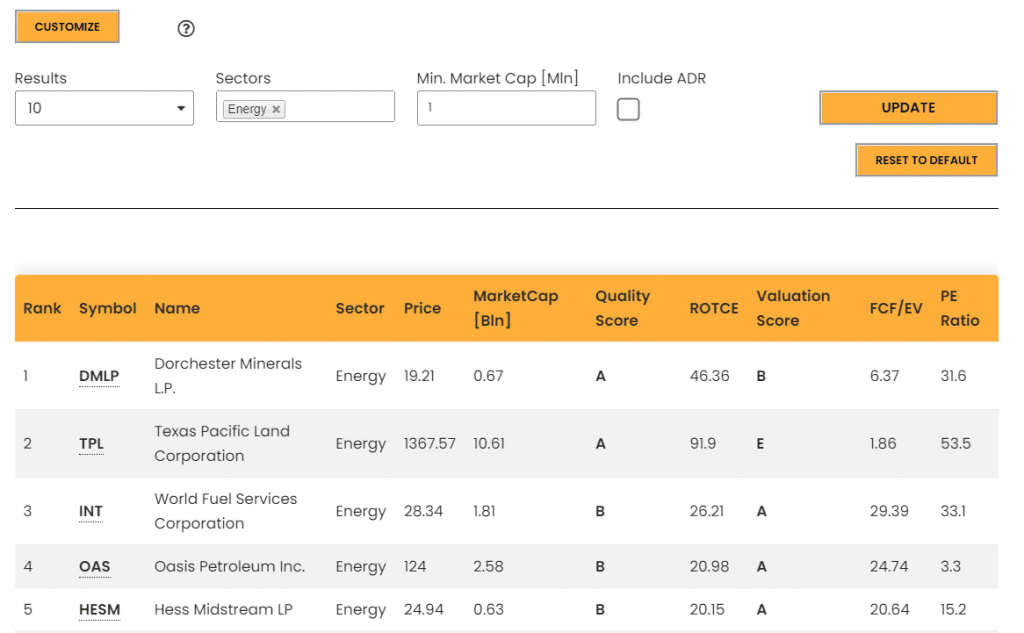

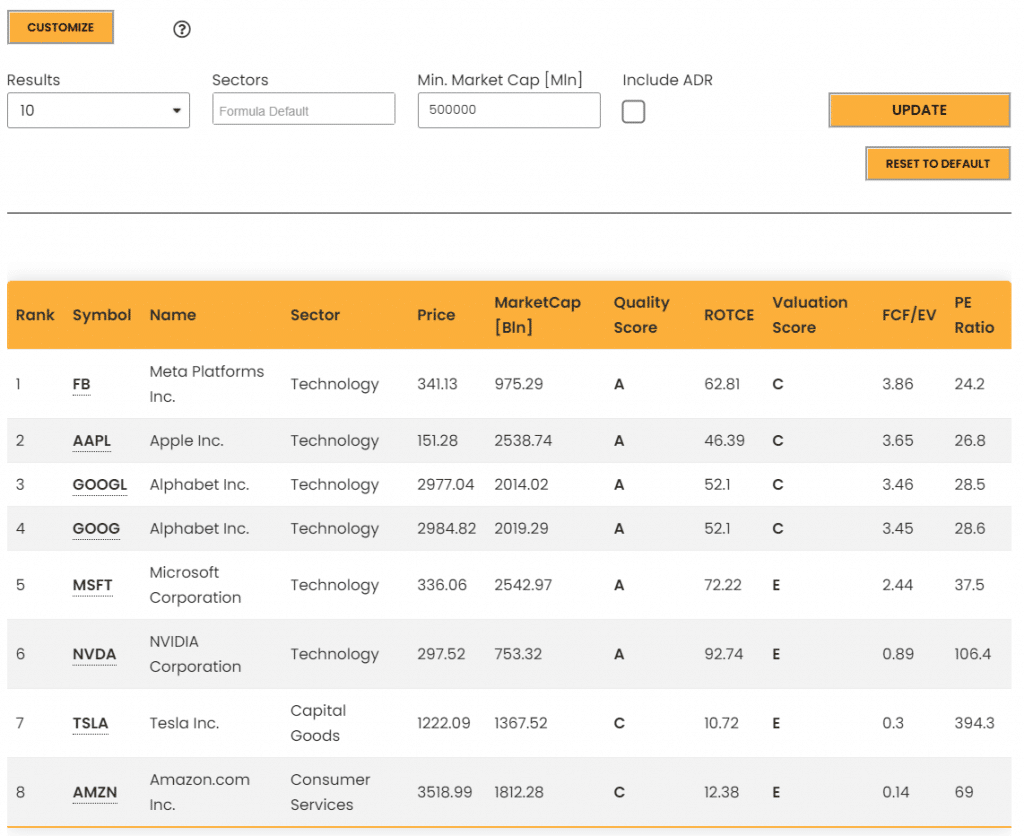

- Results: By default the Screener shows the first 10 ranked stocks, but you can broaden your search by selecting up to 50 results. This is useful if you want to apply the Everest Strategy with more than 10 stocks, or if you simply want to get more results for your customised search.

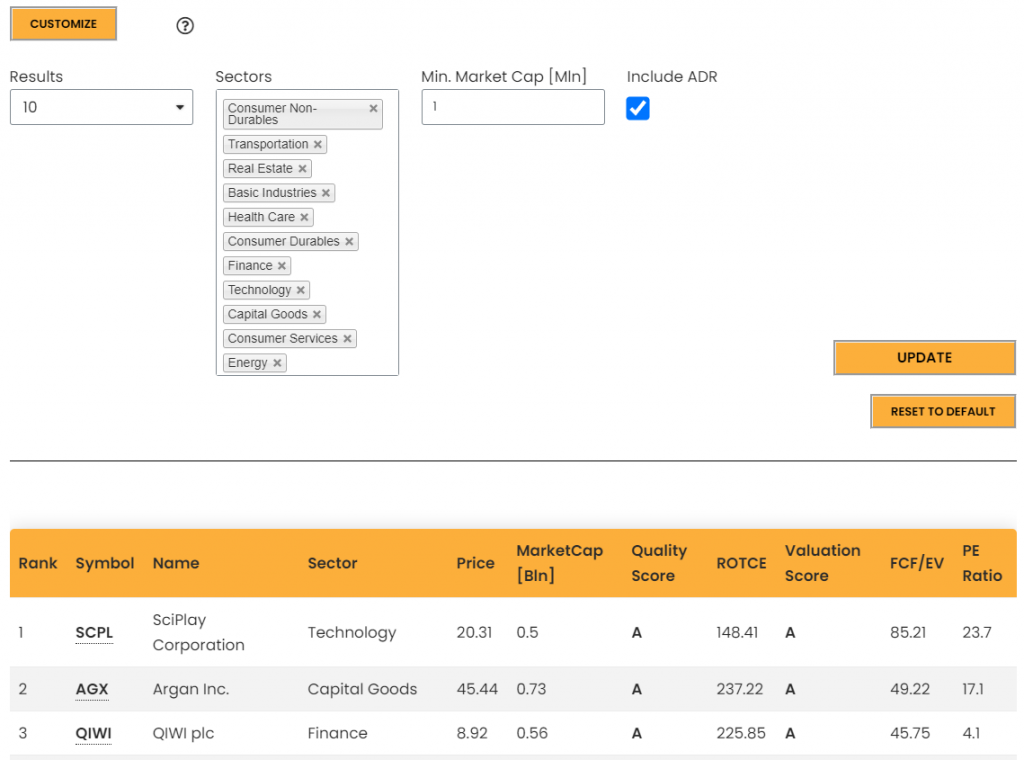

- Sector: You can get the best stocks of a specific sector, or combine multiple, to get a personalized rank based on sectors in which you are more confident or you think they will outperform the broad market in the next future.

- Min. Market Cap: Everest Formula uses a proprietary procedure to determine the minimum company size suitable for the Everest Strategy, but you can select your custom threshold to get a rank that includes only big caps, big and medium caps, or companies of all sizes. For instance, by selecting “1” as Min. Market Cap, you will include all the companies in your research, from 1 Million Market Cap (the minimum) to the biggest companies. By selecting 1,000,000 you will include only the biggest companies, of at least 1 Trillion Market Cap.

- Include ADR: By default foreign stocks (i.e. whose main market is not NYSE, Nasdaq or AMEX) are discarded by the Everest Formula because financial data are more subject to errors for those stocks, due to currency conversions and other factors. But premium users can include them and make their own research to confirm the quality of their data, by enabling this flag.

Here are presented some common use cases:

Everest Analyzer

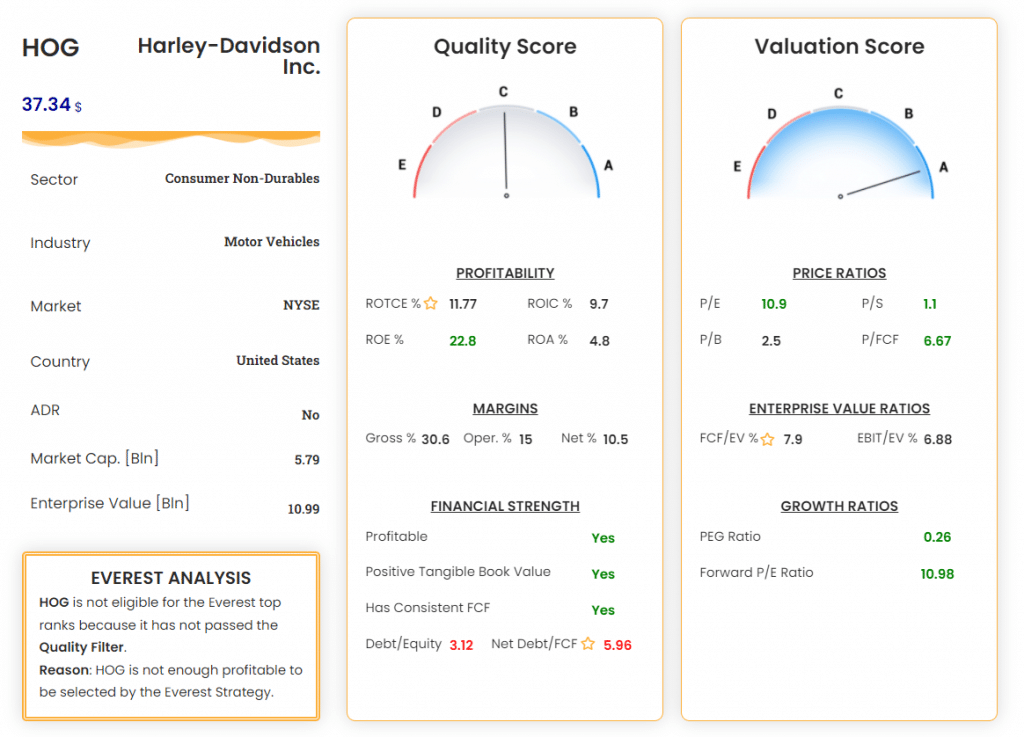

The Everest Analyzer is a powerful tool to get a snapshot of the stock’s current situation, and its underlying company. It lets investors understand the weakness of stocks through the flagging system, pointing out the aspects that need further analysis.

The analysis can be broken down in 4 sections:

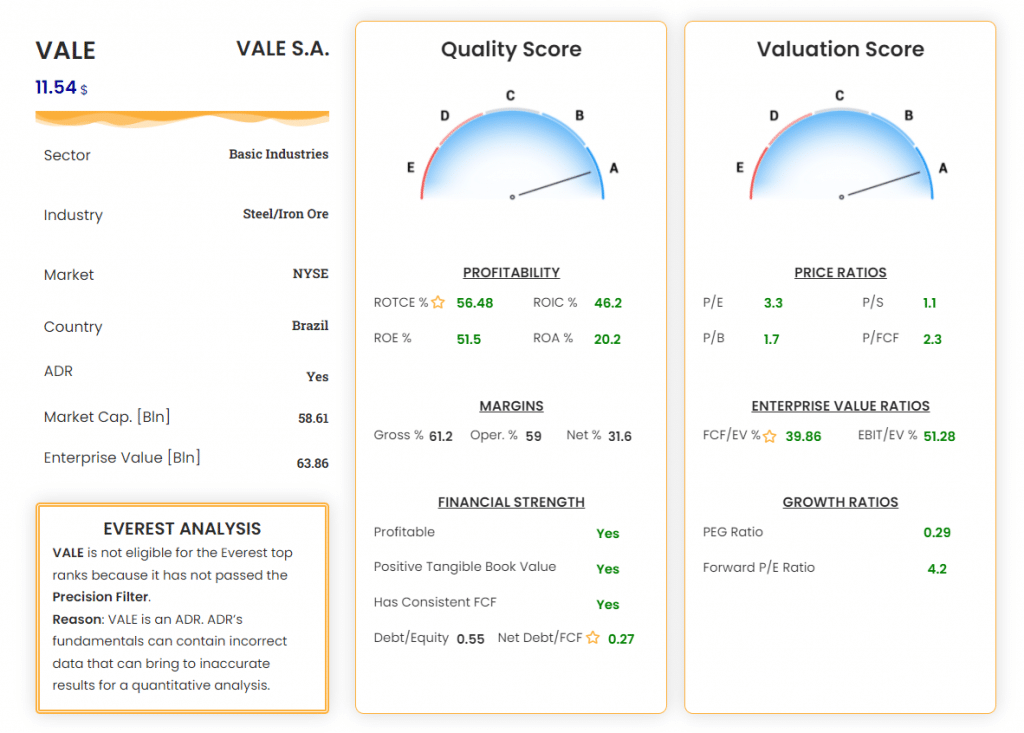

- Stock Name and Ticker, Price, and general information: This section gives an overview of the stock and the underlying company. A complete company overview that describes its business model is also available under the analyzer.

- Everest Analysis widget: The Everest Formula processes the stock through a 4-step validation, and in this widget you find the outcome, that can be:

- Fail on step 1: The stock has not passed the precision filter. More details are given in the reason section.

- Fail on step 2: The stock has not passed the quality filter. More details are given in the reason section.

- Fail on step 3: The stock has not passed the valuation filter. More details are given in the reason section.

- Stock eligible: The stock has passed all the filters and is ranked based on the valuation ranking method. Rank position is given inside the widget.

The Everest Analysis widget is useful to immediately understand why the stock is discarded (if discarded) by the Everest Formula and dig more into the reasons.

- Quality dashboard: A set of metrics that represents the overall quality of the company. The dashboard is composed of 3 sections:

- Profitability: How the company is able to transform its assets into profits. Each metric gives an answer from a different side.

- Margins: Useful metrics to understand the MOAT of the company and the competitors pressure.

- Financial Strength: A look at the company’s balance sheet and the ability of the management to get profits without incurring in heavy debt.

- Valuation dashboard: A set of metrics that represents the valuation of the stock. The dashboard is composed of 3 sections:

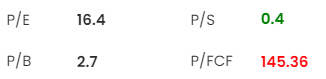

- Price Ratios: Classic metrics that compare the price of the stock with fundamental aspects of the company’s operations, like revenue (P/S), income (P/E), equity (P/B) and free cash flow (P/FCF).

- Enterprise Value Ratios: Enterprise value, differently from the simple price, takes into account the debt level of the company, and can give better indications of the value of a stock.

- Growth Ratios: Valuation metrics that take also into account the expected growth of the company. Useful for companies that rely considerably on their growth.

Flagging System: Each metric of the quality and valuation dashboards is valued by general rules that judge a company in that specific metric. Values are coloured by green, black or red, indicating that a good value, standard value or poor value for that stock.

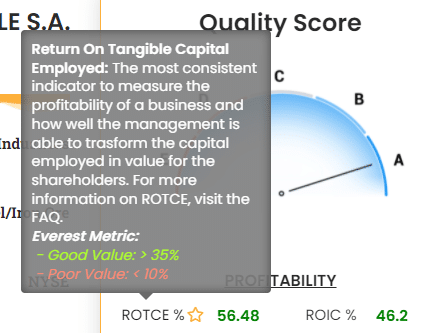

Metric Tooltips: Each metric has an associated tooltip that appears when tapping or hovering on the metric itself. The tooltip shows a complete description of the metric, how it can be useful and what are the threshold values that make the metric considered good or poor for the company.

Analysis Examples

We show two examples in which the Everest Analyzer proves to be a powerful tool in identifying weaknesses and point investors to the right direction.

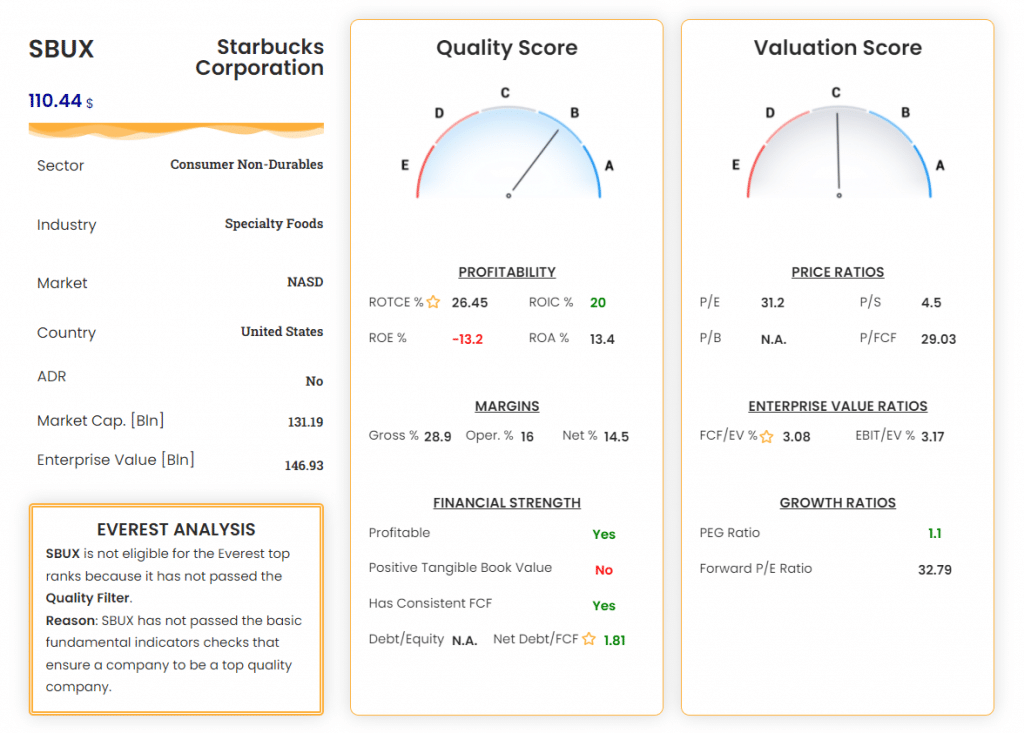

Starbucks Corp. – SBUX: The Everest Analysis highlights the presence of possible problems (as investment) from a quality perspective. Digging into the metrics of quality dashboard, we notice that Starbucks has a good profitability, a big MOAT (indicated by high margins compared to peers in its sector), a contained debt, but a negative equity, pointed by the negative ROE and the negative tangible book value.

At this point the investor should try to find the reason of this anomaly, and come across some articles that explain the reason:

“In Starbucks’ case, it appears to be from two in particular. Firstly, the company has a lot of leverage: it has around $37.2bn in total liabilities and only $29.4bn in total assets. Secondly, the company has been paying out more than it has earned. This can be attributed to the company’s generous buybacks and dividends. Despite only earning a total of $9.03bn net income over the 3 years to September 30 2020, the company has paid out $5.4bn in dividends and spent $19bn buying back company stock in that time. While this has probably pleased many shareholders because it’s resulted in a nearly 100% total return (including dividends) in only 2 years, it is not sustainable in our view.“

This is not a good behavior for a long term investor and should raise a huge red flag.

Harley-Davidson Inc. – HOG: Harley-Davidson is an iconic motorcycle brand of the 80’s and 90’s whose stock appears to be extremely cheap for the current valuation. A negligent investor could be attracted by the extreme low price ratios. Here the Everest Analysis shows two important aspects: a non-optimal profitability (ROTCE and ROA are on the lower threshold) and a remarkable amount of debt. Putting these aspects together with the continuous revenue decrease over the last decade, make the HOG stock an high risk stock that the investor should carefully inspect before making an investment.

Conclusions

The premium membership provides two powerful tools that help investors to find the best stocks in the market and to make their investment decisions become aware of every aspect of a company. if you are interested in using the premium features described here, please consider Join now.