- Investing in the stock market is one of the best ways to grow your wealth, but it’s not without risk. While many companies can provide a healthy return on investment, some can end up losing you money.

- In this article, we’ll explore five key factors that can help you identify companies that might not be a good investment choice.

- The Everest Analyzer is a powerful tool that can help you find some of these weaknesses.

Are you interested in buying the best stocks and avoiding bad companies? Premium members can use the Everest Screener to get the most valuable companies to invest in for each sector every day. Join now!

Introduction

Warren Buffett once said that the first rule of investing is to avoid losing money. It’s a sensible rule but not an easy one to stick to. Like most of us, Buffett has occasionally picked a stock that has declined.

The odd slip is fine and, of course, there are unexpected market events that can wipe away value from your portfolio. But sensibly-selected individual stocks recover from adverse market events. Conversely, individual stocks don’t tend to recover when something in their core is inherently wrong.

And significant share price declines from a poorly selected stock pick are tough to recover from – after all, to recover a 50% loss requires a 100% gain. Therefore, although it may not sound so appealing, the best rule for investing may be to minimize losses. In other words, pick stocks sensibly to avoid disasters that could make a material dent in your portfolio’s performance.

Fortunately for stock pickers, most companies exhibit warning signs before they collapse into oblivion and learning how to identify those warning signs can help you avoid expensive bad decisions.

Let’s explore five key factors that can help you identify companies that will likely lose value over time.

1) Poor Financial Performance

The first sign that a company may not be a good investment choice is if it has a history of poor financial performance. This can include low or declining revenues, high debt levels, and inconsistent profits. So, before investing in a company, look at its financial statements to get a sense of its financial health.

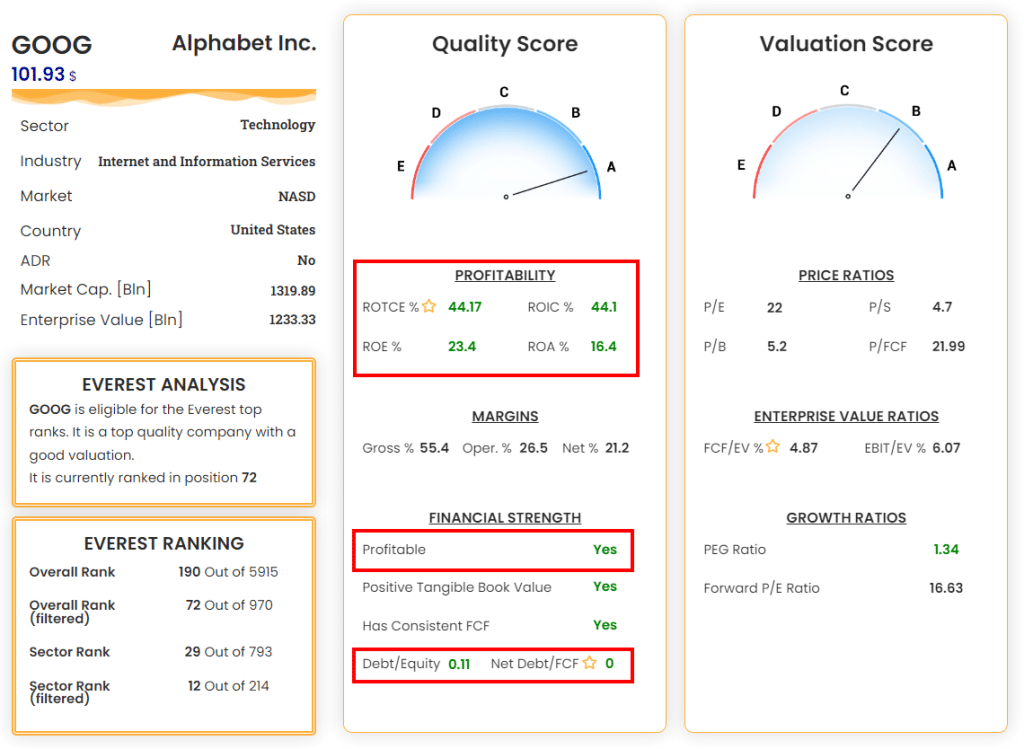

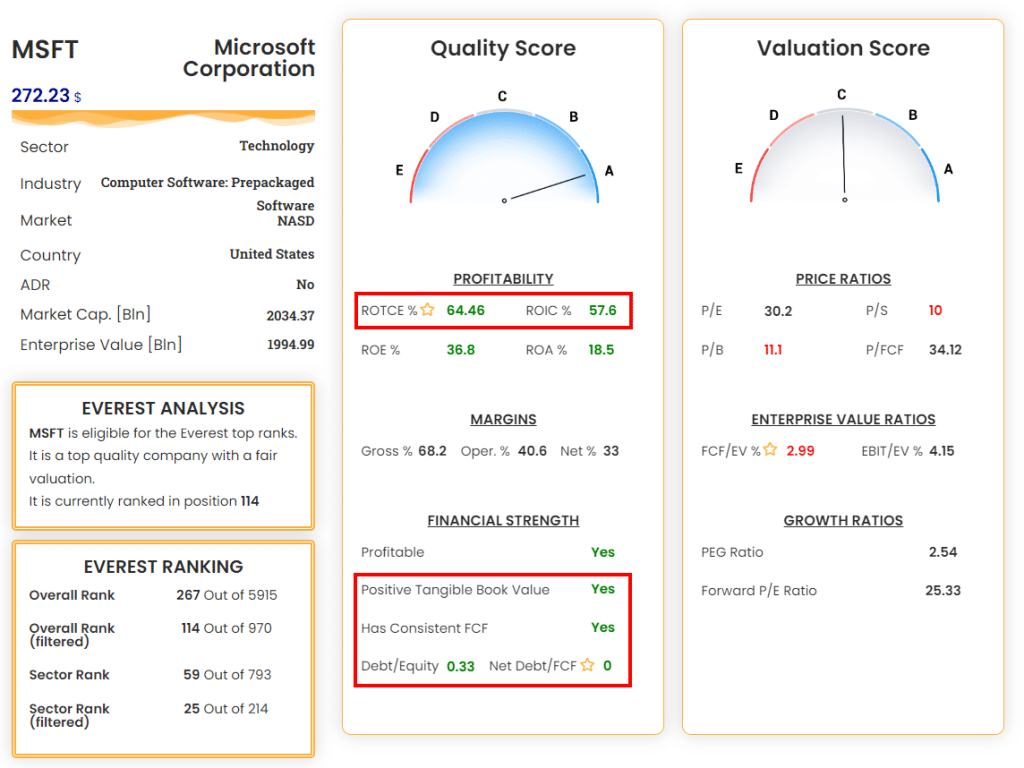

The Everest Analyzer shows investors all the most critical metrics needed to evaluate a company’s performance:

2) Lack of Competitive Advantage

Companies that don’t have a competitive advantage are often at risk of losing market share to competitors. This can result in declining revenues and profits, ultimately leading to a decrease in the company’s stock price. Therefore, when considering an investment, look for companies with a clear and sustainable competitive advantage, such as a strong brand or proprietary technology.

Other than a qualitative assessment of the brand strength and company’s MOAT, look for the following metric that helps you understand if the company has a sustainable competitive advantage over its competitors:

- Declining revenue and profits: If a company’s revenue and profits have been declining over time, it may indicate that it is losing its competitive edge and struggling to stay ahead of its competitors.

- Low profit margins: If a company’s profit margins are consistently lower than its competitors, it may indicate that it is unable to command higher prices or has higher costs that make it less competitive.

- Low return on investment: If a company’s return on investment is lower than its competitors, it may indicate that it is not investing in the right areas or not making strategic investments that will lead to long-term growth.

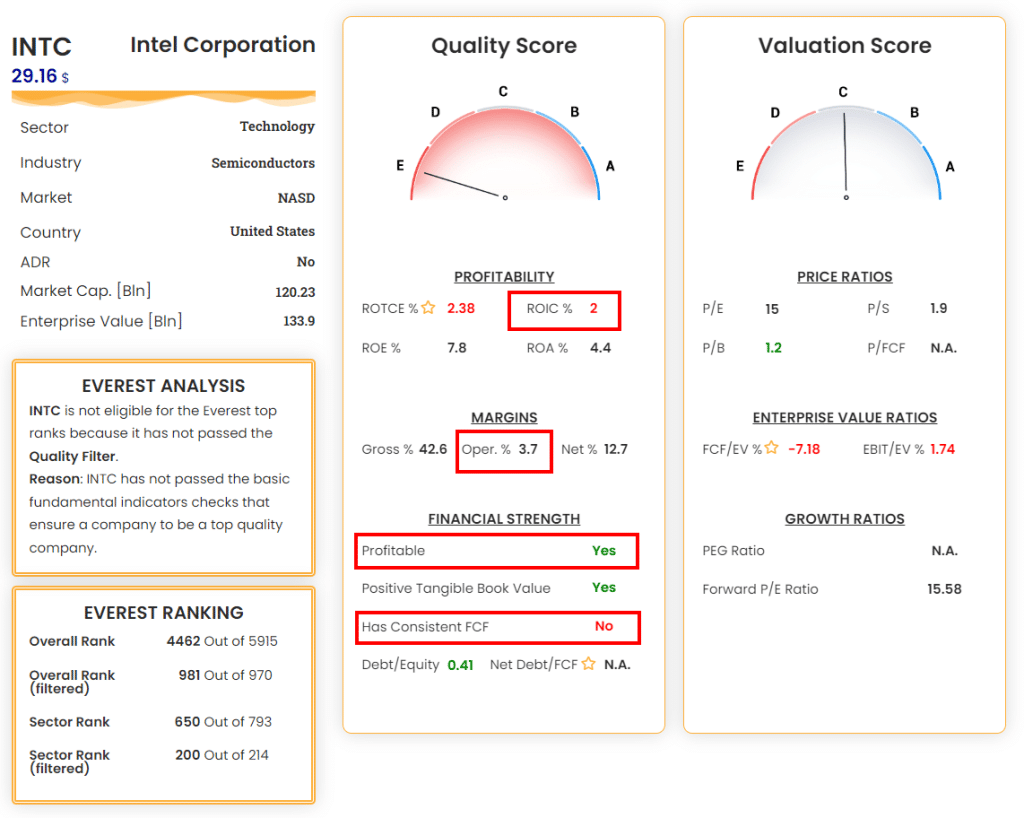

The following analysis by the Everest Analyzer shows how Intel has lost its competitive advantage to competitors, and now it is struggling:

3) Weak Management

A company’s management team is crucial to its success or failure. If a company’s management has a history of poor decision-making, lack of transparency, or unethical behavior, it could be a red flag.

Identifying weak management through financial data can be challenging, as financial data alone may not provide a complete picture of the company’s management. However, several key financial indicators can help you evaluate a company’s management quality:

- Profitability: A company’s profitability is a good indicator of the quality of its management. Consistently declining profits, or a low profit margin, may indicate that the management is not effectively controlling costs, managing expenses, or generating revenue.

- Debt levels: High debt levels can be a sign of poor management. If a company is heavily leveraged, it may be vulnerable to interest rate hikes or economic downturns, which could put the company at risk of defaulting on its loans.

- Cash flow: Positive cash flow is critical to a company’s success, and poor cash flow management can indicate weak management. If a company is consistently burning through cash, it may be a sign that management is not effectively managing working capital or investing in growth opportunities.

- Capital allocation: How a company allocates capital is a critical decision for management. If a company consistently makes poor investment decisions or fails to invest in growth opportunities, it may be a sign of weak management. The return on invested capital metric is the best indicator to check when the capital allocation needs to be evaluated.

The Everest Analyzer gives investors at a glance all the most important metrics to evaluate a company’s management:

In addition to financial indicators, there are other ways to evaluate the quality of a company’s management, such as researching the management team’s track record, their reputation in the industry, and their communication with shareholders. Evaluating a company’s management from multiple angles is important before making an investment decision.

4) Overvalued stocks

Investing in companies with inflated valuation multiples carries a high risk of negative returns in the following years if these metrics become compressed due to a shift in market sentiment. This usually happens regardless of the quality of the underlying company.

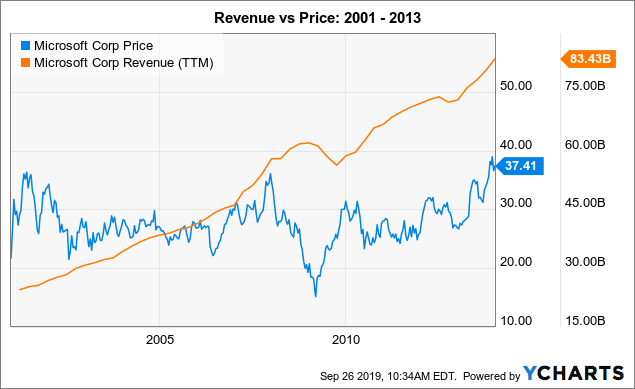

Stocks can go from being extremely overvalued to gradually becoming undervalued even if they continue to grow and operate well in their business, only due to a shift of investor sentiment toward the company. That is the case in Microsoft from 1999 to 2012, whose stock had a flat return even if the company had good growth during that period.

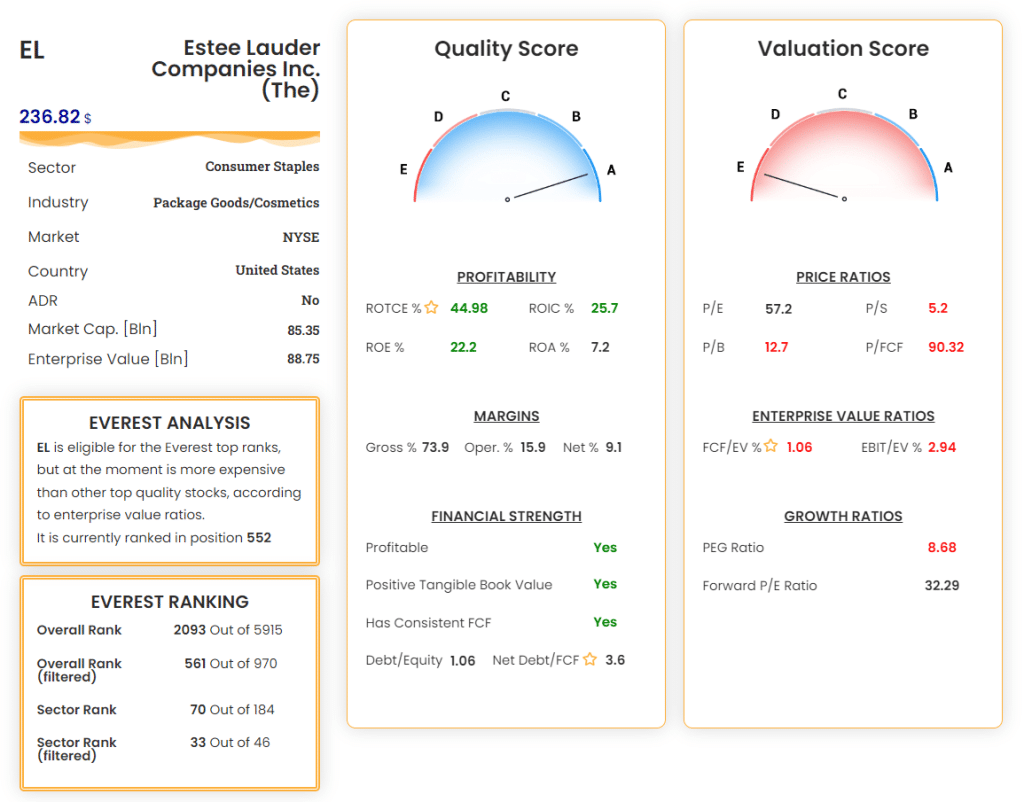

That’s why the Everest Analyzer has a dedicated section to the company’s valuation. Many relevant metrics are shown at a glance, and investors can rapidly judge if a stock is undervalued or overvalued.

From the following image, we can understand that Estee Lauder (EL) is another example of a good but overvalued stock that will probably underperform the market in the years to come:

5) Industry Disruption or Regulatory Issues

Two additional factors can bring negative performance and are more challenging to unearth. They can’t be found in data but require a careful qualitative analysis of the market and the company’s context.

The first one is industry disruptions: industries constantly evolve, and companies that fail to adapt can quickly become obsolete. If a company operates in an industry disrupted by new technologies or changing consumer preferences, it could be at risk of losing market share and revenue. Before investing in a company, research the industry and look for signs of disruption that could impact the company’s prospects.

The second one is regulatory issues: companies embroiled in legal or regulatory issues can be risky investments. Legal issues can result in costly fines and lawsuits, while regulatory issues can lead to increased costs and decreased revenues. Before investing in a company, research its legal and regulatory history to understand any potential risks.

Conclusions

Investing in the stock market can be a great way to grow your wealth, but it’s important to do your due diligence before making any investment decisions. By researching a company’s financial health, competitive advantage, management team, valuation, and industry disruption and regulatory history, you can identify companies that might not be a good investment choice and avoid losing money.

Remember, investing always involves risk, so having a well-diversified portfolio and a long-term investment strategy is important.

The Everest Analyzer can help you filter the companies that meet your investment requirements and understand the stocks to avoid. If you want to find the best stocks to own, consider Joining our community.

Happy Investing!