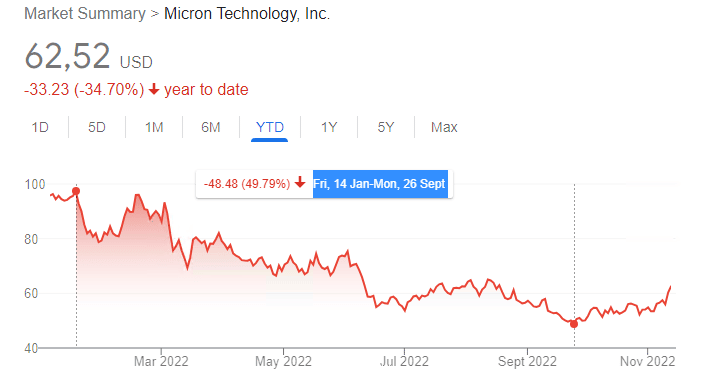

- The semiconductors industry has been hit by a massive sell-off during 2022, driven by weakening consumer spending and a rising interest rates environment.

- Among all the most-known companies in the sector, Everest Formula has recognized Micron Technology as one of the most interesting companies, which deserves an in-depth analysis.

- In this article, we are going to analyze the stock, both using the most important indicators of the Everest Analyser and by calculating the intrinsic value of the stock with a Discounted Cash Flow model.

Are you interested in finding the best value stocks in each sector on your own? Premium members can use the Everest Screener to get the most valuable companies to invest in for each sector every day. Join now!

Introduction

Micron, like any company in the semiconductor field, has had an uninspiring 2022. After a global chip shortage in 2021, demand has receded significantly. Sales for many big-ticket electronics, such as laptops and televisions, have decreased considerably from last year’s record levels. As the stay-and-work-at-home trends have diminished, consumers are focusing their spending elsewhere, such as on travel and recreational goods. In addition, the inflationary wave has further hit consumer spending power for electronics.

Anyway, investors must keep in mind that this is a deep cyclical sector in which periods of high demand alternate with demand crises in a constant and inescapable cycle. Buying these stocks during market downturns is a unique opportunity to grab outsized returns, and Micron could be one of the best value play in this sector at the moment, as we’ll see in this article.

Micron – Overview and current situation

Micron Technology, Inc. (NASDAQ: MU) is a leading memory and storage chip manufacturer based in the United States. After going through several decades of competition and economic cycles, MU has become one of the U.S. flagship companies in the semiconductor field, along with Intel.

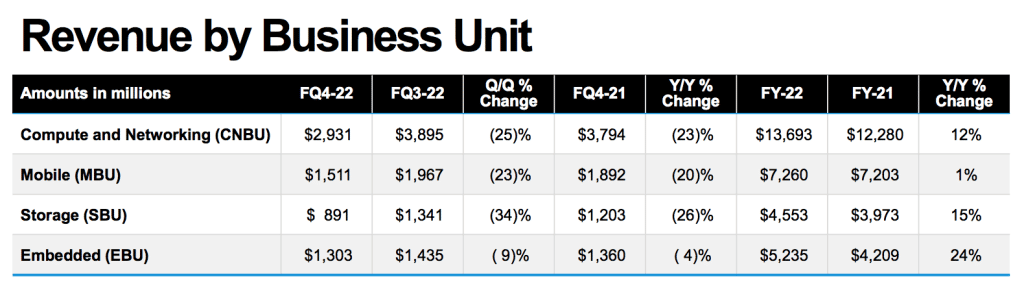

The company operates on four segments: Compute and Networking Business Unit, Mobile Business Unit, Embedded Business Unit, and Storage Business Unit.

There are five big players in the memory industry: Toshiba, Western Digital, Micron, Samsung and Hynix. The economies of scale of these five are so good that smaller players cannot compete with them. A new company in this industry has to make at least 100K wafers per month in their factories (that costs billions) if they want to succeed in not losing money. The market can also consume new technology really fast, and new products are constantly changing the dynamics of the industry.

Therefore, the first takeaway for investors is that it is extremely difficult for an entrant to disrupt the dominance of current players. This gives MU the tag of a company with a big “MOAT”.

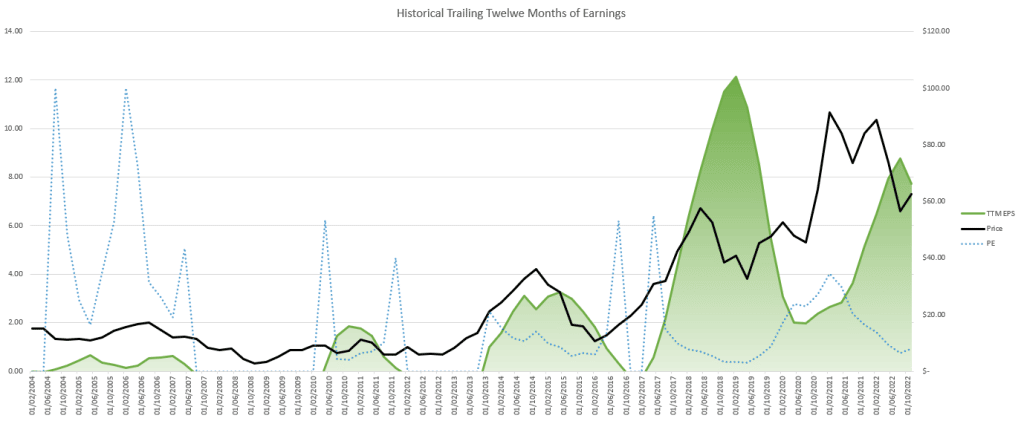

Now, let’s look at the historical earnings and prices for Micron Technology:

Historically earnings go deeply negative during downcycles, so deep that there are times when Micron has had 2 or 3 years where they lose money. However, eventually, earnings have always bounced back from these declines and have typically done it in a reasonably timely manner.

The second very important takeaway from the graph above is that in every cycle over the past 20-year earnings have experienced a higher peak than the previous cycle and also a higher low than the previous cycle. This creates a secular growth trend. And we all know from common observation of our society and economy that demand for memory has been growing rapidly over this time period, so this pattern makes intuitive sense. We can infer that, even when earnings are declining and the price is falling, MU cannot be considered a value trap.

Investment thesis

Micron is a company with a big MOAT that needs to be taken into consideration by investors for these key factors:

- MU has survived decades of economic downturns and has been a proven winner and survivor, so it is reasonable to say that although earnings have started to decline recently, MU is unlikely a value trap.

- Management has done a great job with the business. The CEO, Sanjay Mehrotra, co-founded SanDisk and has been in the memory business since 1988. He is a guru in this field, and since he took the lead at Micron, he has guided the company to unprecedented success.

- Debt-to-equity is actually extremely low for MU compared to their historical levels. This is a sign of a healthy company with a lower risk than its peers.

Risks in investing in Micron

There are some risks to evaluate before investing in Micron Technology:

- Memory manufacturing is known to be a commodity-like business and very cyclical. Analyzing the timing of different stages in the industry cycle is often the key for investors. Buying the stock at the cycle’s peak or at the wrong moment could lead to negative returns for investors for years.

- Micron has most of its assets based in Taiwan. A hypothetical invasion of Taiwan from China (a fear that has recently increased) may do significant and perhaps irreversible damage to the business.

- Even though the stock brings good returns over the next years, it is highly volatile, and some types of investors may feel uncomfortable with the large fluctuations of its share price, taking to premature selling.

Let’s make a quantitative and qualitative stock valuation, considering the strengths and risks mentioned so far.

A look at Micron using the Everest Analyzer

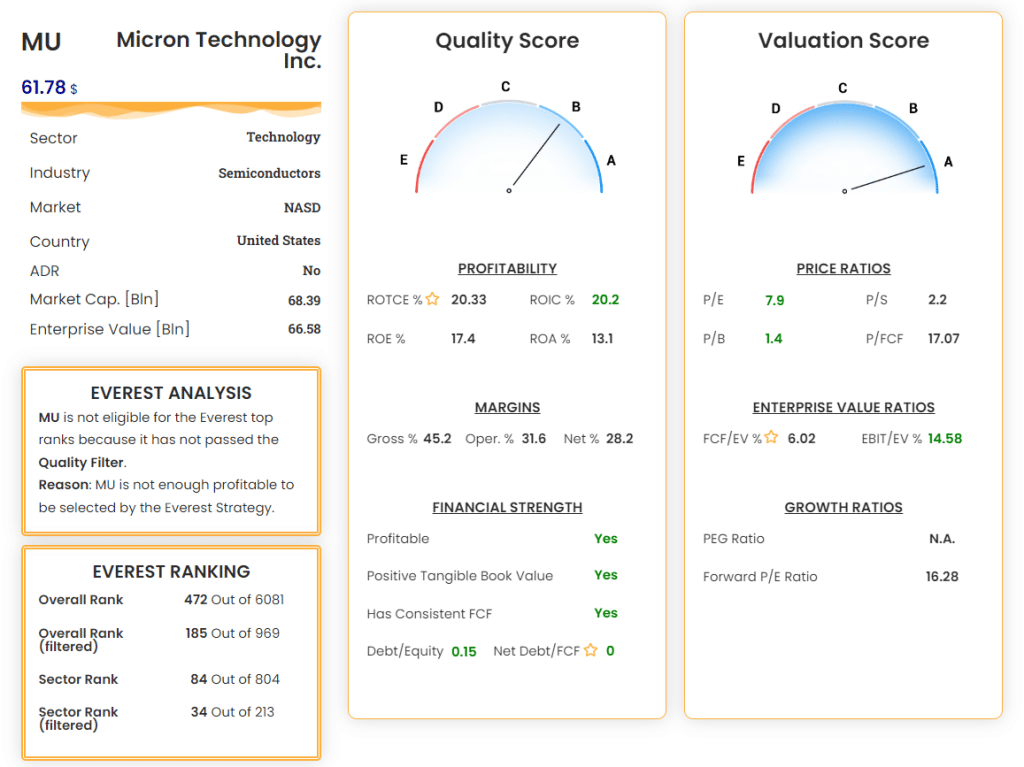

Quality Score: Micron is a solid company that has drastically reduced its debts in the last years and has management able to bring good profitability and margins. Debt and margins are consistently better than the industry average, while the profitability is good, even if not excellent. The Everest Analyzer assigns a score of B to its quality. In order to have a perfect score, it should increase its ROTCE, which is under the industry median (43.8%) and under the threshold of 35%, which the Everest Formula considers a good target value.

Valuation Score: Almost all the most important valuation metrics are better than the median of the Semiconductors industry average: the P/E ratio of 7.9 is well below the average (21.4), as well as the P/S (2.2 versus 4.3) and the FCF/EV (6.02% vs 4.29%). The Everest Analyzer assigns a perfect score of A to its valuation.

Evaluation of Micron through Discounted Cash Flow

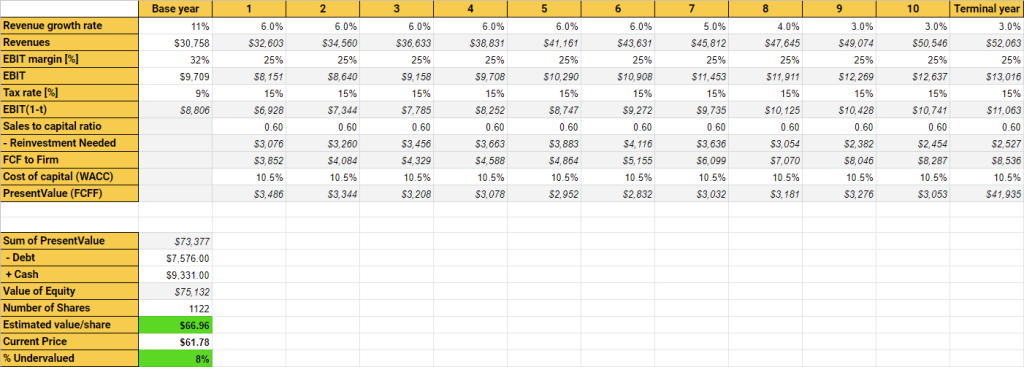

We proceed to analyze Micron through a DCF model. Considering this is a highly cyclical stock, the assumptions must be considered average values that could vary considerably from year to year.

Here are the assumptions we made considering the company’s strengths and weaknesses:

- Future Revenue Growth: MU has guided for high single-digit revenue growth over the medium term. We assumed a conservative average of 6% annual growth for the next 6 years before aligning with the market average growth.

- Future Operating margins: We assume that Micron will maintain an average operative margin of 25%, in line with its recent past.

- Future effective tax rate: We assume that Micron in the future will have an average tax rate of 15%, more than the last years but less than the average U.S. tax rate (21%).

- Future sales-to-capital ratio: We assume that Micron will maintain an average sales-to-capital ratio of 0.6, in line with its recent past.

- Discount rate: We choose to discount the future cash flow with the Weighted Average Cost of Capital (WACC), which is the most reliable way to value a company because it considers its risks and the overall market outlook. We computed a WACC of 10.5% for Micron.

With these inputs, we are able to estimate year by year the expected free cash flow in the hand of the company, from year 1 to year 10, in which we assume to sell the stock. Summing up all these discounted FCF, and subtracting debt and adding current cash, we obtain an intrinsic value for each share of $66.96.

Given our calculations and the current price of 61.78$, the stock seems 8% undervalued. But given the uncertain nature of estimates and the need for an adequate margin of safety before buying a stock, we would prefer an undervaluation of at least 20% before considering Micron a buy. So our buy price is currently $53.57.

Here you can download the template used. You can modify the assumptions and extract your own intrinsic value.

Conclusions

The semiconductors industry is one of the best industries to look at now, given the opportunities that the recent sell-off has brought to investors, and Micron is one of the best companies to keep under watch. The current price already seems to be a good entry point, although we would prefer a further decline before entering with a substantial portion of the portfolio.

Although Micron stock is unsuitable for investors uncomfortable with high-volatile stocks, this company has a long history of providing good returns for long-term investors.

The Everest Formula is not only a successful investing strategy but also a powerful stock analyzer that can be used to seek out value stocks in any sector and any market condition.

So, what are you waiting for? Join our community!