- After the pandemic crisis, in which Pfizer has showcased impressive growth in sales and stock performance, the stock has been shattered due to the return to a normalized environment.

- Despite the pessimism, PFE’s valuation seems to have reached an attractive level. Pfizer is a big pharma behemoth and has proved its ability to build its products franchise.

- In this article, we will analyze Pfizer stock using the most important metrics of the Everest Analyzer and by calculating the stock’s intrinsic value with a Discounted Cash Flow model.

Are you interested in finding the best value stocks in each sector on your own? Premium members can use the Everest Screener to get the most valuable companies to invest in for each sector every day. Join now!

Don't miss new Blog Posts in your email

Pfizer Stock Analysis – Introduction

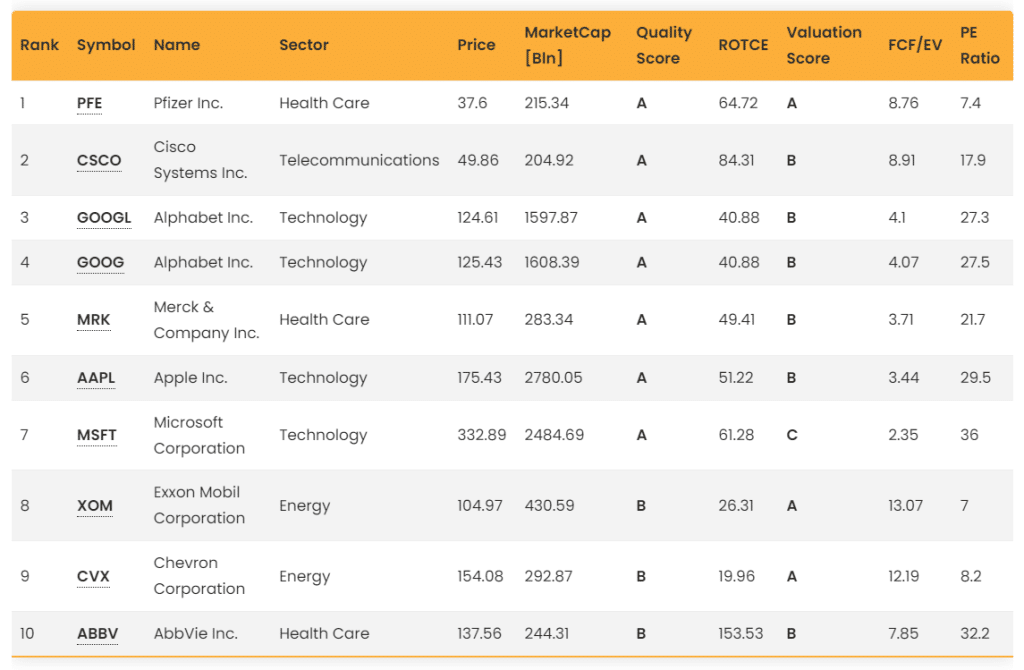

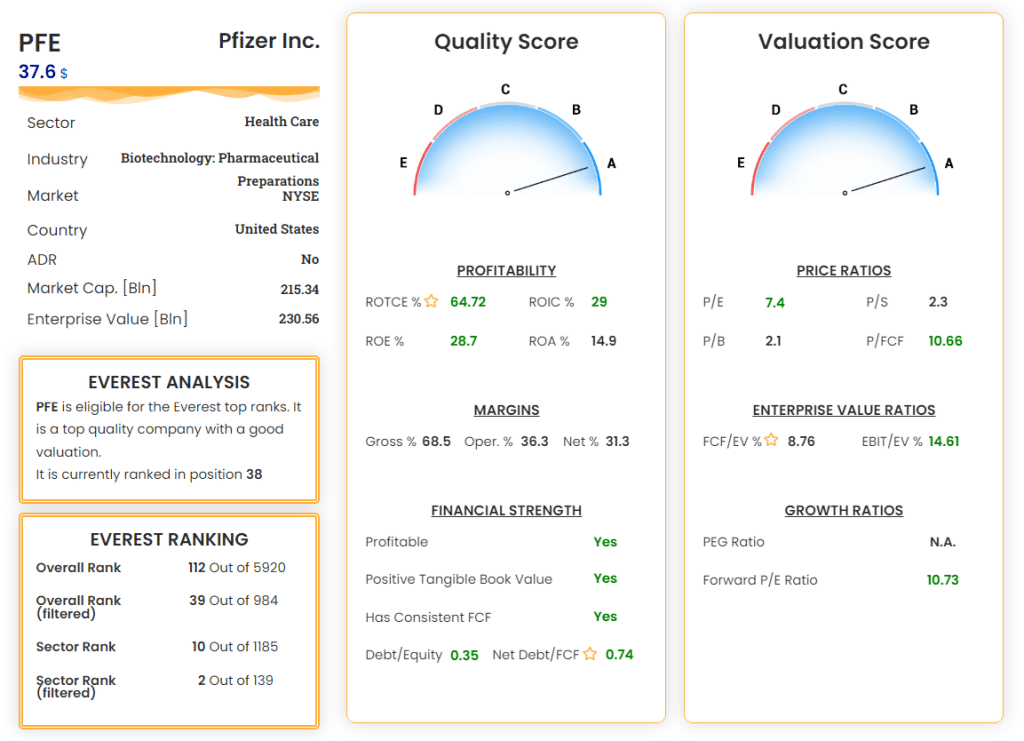

Looking at Everest Formula’s screener in the sector of large-capitalization companies (with a market cap greater than 200 billion dollars) in search of possible bargains in the market, we noticed that the first position is occupied by the renowned market leader in the pharmaceutical industry, namely Pfizer.

Pfizer, a global pharmaceutical powerhouse, has established itself as a leading player in the healthcare industry. With a rich history spanning over 170 years, the company has built a strong reputation for its innovative research, development, and production of life-saving medications. This article delves into a comprehensive analysis of Pfizer’s business performance, encompassing recent sales figures and stock performance.

Company Overview

Pfizer offers a broad range of pharmaceutical products catering to various therapeutic areas. The company’s portfolio includes prescription and over-the-counter medications, vaccines, and consumer healthcare products. Pfizer’s product list is impressive; these are just a few of their products:

- Cardiovascular and Metabolic Diseases: Lipitor (A widely recognized cholesterol-lowering medication). Norvasc (A calcium channel blocker used to treat high blood pressure and angina). Eliquis (An oral anticoagulant for reducing the risk of stroke and blood clots).

- Oncology: Ibrance (a targeted therapy for advanced breast cancer). Xalkori(A treatment for specific types of lung cancer). Xtandi(an androgen receptor inhibitor used in the treatment of prostate cancer).

- Immunology and Inflammation: Enbrel (a biological medicine for autoimmune diseases such as rheumatoid arthritis and psoriasis). Xeljanz (an oral medication prescribed for rheumatoid arthritis and other inflammatory conditions). Eucrisa (a topical ointment for the treatment of mild-to-moderate eczema).

- Rare Diseases: Vyndaqel and Vyndamax (medications used to treat hereditary transthyretin-mediated amyloidosis). Tafamidis(an oral therapy for the treatment of transthyretin familial amyloid polyneuropathy). Hemophilia Products.

- Vaccines: Prevnar 13 (a pneumococcal conjugate vaccine to prevent pneumococcal disease, including pneumonia and invasive infections). Comirnaty (developed in collaboration with BioNTech, this mRNA-based vaccine is used for COVID-19 immunization).

- Consumer Healthcare: Advil (an over-the-counter pain reliever for headaches, muscle aches, and fever). Centrum (a line of multivitamins and dietary supplements). ChapStick(a popular lip balm brand for moisturizing and protecting lips).

Current Outlook

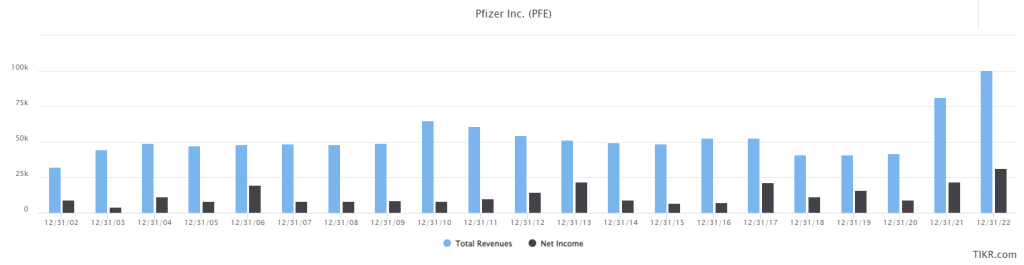

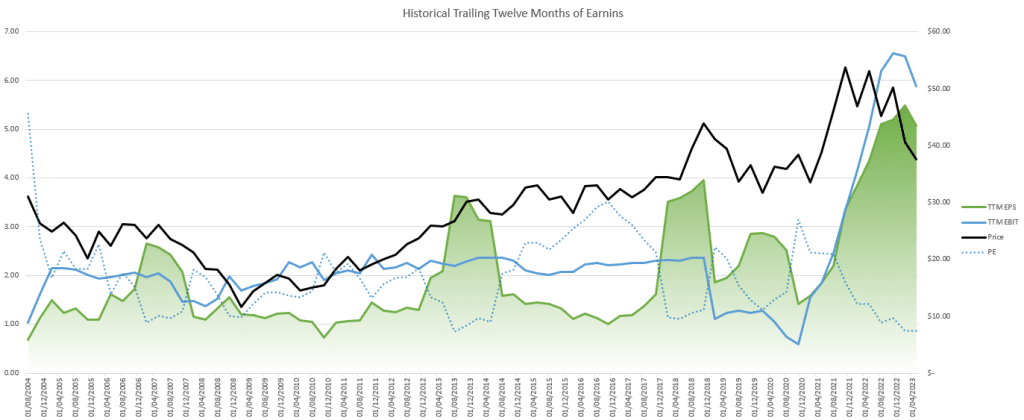

In recent years, Pfizer has showcased impressive growth in both sales and stock performance, thanks also to the Covid tailwind and the outstanding sales of its vaccine. The company’s sales and income figures have been consistently robust over the last 20 years, driven by a diverse portfolio of pharmaceutical products catering to various therapeutic areas. Pfizer’s strategic focus on developing groundbreaking treatments has contributed significantly to its revenue growth. One of the most impressive things is that the net income has always been positive over the last 22 years, even during recessions. Pfizer is an outstanding defensive stock.

Despite the company’s proven strength, the stock has continuously declined over the past two years. Now it has reached the lowest value recorded since April 2021. This is mainly because after the spike in sales recorded thanks to the vaccine developed by Pfizer for the pandemic, the market now expects a return to pre-pandemic sales and doubts that Pfizer can once again bring out a new product capable of returning the company to grow.

Investment thesis

Although the current market expectations are understandable and based on solid arguments, it should not be forgotten that in the past two years Pfizer has produced a significant cash flow that has been used to improve the balance sheet (debt to equity has decreased from 84% to 35%) and to make acquisitions with a view to growth and gaining market share. This means that now we could buy a company that is significantly better than if we bought it before the pandemic. Moreover, beyond the pandemic, Pfizer has acquired expertise in vaccine development and a robust pipeline of promising drug candidates that position the company for continued growth and innovation.

Other than that, there are other advantages to investing in Pfizer stock:

- Strong Financial Performance: Pfizer has consistently delivered strong financial results, showcasing its ability to generate substantial revenue and profits. This stability can be attributed to its established brands, patent-protected products, and ongoing research and development investments. Such financial resilience bodes well for long-term investors seeking consistent returns.

- Diverse Product Portfolio: Pfizer’s extensive range of products spans therapeutic areas such as cardiovascular, oncology, immunology, and rare diseases. This diversification mitigates risks associated with overreliance on a single product or therapeutic category, ensuring a balanced revenue stream. Moreover, Pfizer’s continuous efforts in expanding its portfolio through strategic acquisitions and partnerships further enhance its growth potential.

- Focus on Innovation and Research: Pfizer’s commitment to research and development remains a core driver of its success. The company invests heavily in cutting-edge technologies, clinical trials, and collaborations to discover novel therapies. Pfizer’s ongoing innovation efforts foster a competitive advantage, ensuring its relevance in an ever-evolving healthcare landscape.

Risks

It is essential to acknowledge the potential risks associated with investing in Pfizer:

- Pfizer has six key medicines whose patents are expected to expire by 2028. When patents expire, pharmaceutical companies can produce generic versions of the branded drug, leading to more competition and lower patient costs as healthcare providers seek to move patients to cheaper generics. The combined sales of those medicines whose patents are expiring account for 23.1% of Pfizer’s total sales, not a negligible amount. To avoid a revenue decline, Pfizer needs to cover this part of its revenue that is at risk with new products or patents.

- Overpaid acquisitions: Since the beginning of 2021, the company’s management has pursued an aggressive M&A policy, which has not been observed for many years. The latest acquisition is Seagen, a company that develops promising cancer-fighting medicines but is still a loss-making company. Pfizer will pay a massive amount of $43B to acquire Seagen, 20% higher than its market capitalization. This could negatively affect Pfizer’s income in the next 5-6 quarters and reduce its financial flexibility in the post-COVID-19 era.

- Pfizer operates in an uncertain sector. A company’s success in the healthcare sector is substantially based on the success of clinical trials and the approval of new drugs. Failure to meet regulatory requirements or to demonstrate clinical efficacy can result in setbacks, impacting Pfizer’s pipeline and potential future revenue.

Let’s make a quantitative and qualitative stock valuation, considering the strengths and risks mentioned so far.

A look at Pfizer using the Everest Analyzer

Quality Score: as previously mentioned, Pfizer is a cash flow machine whose earnings have always been positive, even during deep recessions. The total debt is low, and it is constantly decreasing since 2019. The operative margin (36%) is well above the industry average (17%), as well as the profitability (ROTCE and ROIC respectively of 65% and 29% versus the industry average of 37% and 14%). Pfizer deserves a perfect quality score of A.

Valuation Score: The valuation of Pfizer is just as good. The P/E ratio is low, especially compared to peers, which have a median value of 22. The FCF/EV is good and better than the industry average (8.8% vs 5.1%), even if there are companies with better values here. Finally, Price-to-Sales and Price-to-Book ratios are just fine and similar to companies in this sector and with this market cap. Pfizer receives a score of A even in the valuation part.

Evaluation of Pfizer through Discounted Cash Flow

We proceed to analyze Pfizer through a DCF model. We are going to estimate the future growth, profitability and cash flows and actualize them to extract a fair value, comparing it to the current price.

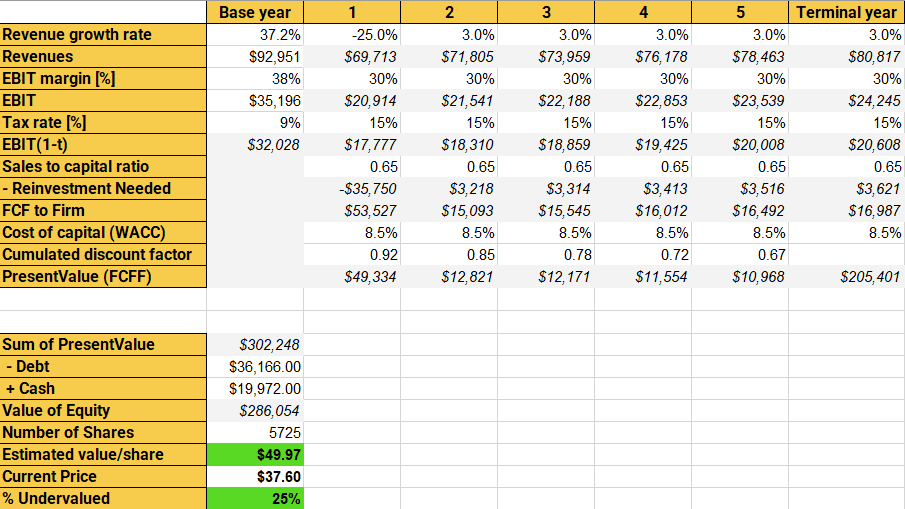

Here are the assumptions we made considering the company’s strengths and risks:

- Future Revenue Growth: Pfizer expects to shrink consistently its revenue next year after the spike in sales recorded thanks to the vaccine. We expect a 25% decrease in sales next year, and then we expect an average of 3% yearly growth in perpetuity. This is a conservative valuation, given that Pfizer has grown on average 5% per annum over the last 20 years.

- Future Operating margins: We assume that Pfizer, after the current spike in margins, will maintain an average operative margin of 30%, in line with its past.

- Future effective tax rate: We assume that Pfizer in the future will have an average tax rate of 15%, more than the last year but less than the average U.S. tax rate (21%).

- Future sales-to-capital ratio: We assume that Pfizer will maintain an average sales-to-capital ratio of 0.65, in line with its recent past and the industry average.

- Discount rate: We choose to discount the future cash flow with the Weighted Average Cost of Capital (WACC), which is the most reliable way to value a company because it considers its risks and the overall market outlook. We computed a WACC of 8.5% for Pfizer.

DCF Outcome

With these inputs, we can estimate year by year the expected free cash flow generated by the company from year 1 to year 5, in which we assume to sell the stock. Summing up all these discounted FCF, subtracting debt and adding current cash, we obtain an intrinsic value for each share of 49.97$.

Given our calculations and the current price of 37.60$, the stock seems 25% undervalued. The stock is remarkably undervalued and should be seriously considered by value investors as an excellent and undervalued stock.

Here you can download the template used. You can modify the assumptions and extract your own intrinsic value.

Pfizer Stock Analysis – Conclusions

We scoured the market for good deals and came across Pfizer, a solid company that has demonstrated resilience during market crashes and is now deeply undervalued. Despite the current negative market sentiment towards Pfizer, it has a solid product pipeline and is poised to resume growing after the recent decline. The Everest Formula is a successful investing strategy and a powerful stock analyzer that can seek out value stocks in any sector and market condition.

So, what are you waiting for? Join our community!