- The bear market of 2022 crushed the valuations of many companies across all industries.

- For value investors, this is the best time to find opportunities to catch for the long term and increase their wealth.

- In this article, we will go over our top five stocks to buy for 2023. We believe these undervalued stocks will perform extremely well over the long term, starting the next year.

Note: In this article, we are NOT going to show the very best five stocks recommended by the Everest Formula algorithm, which helped investors obtain an astounding 30% CAGR over the last 22 years. If you are interested in discovering them, consider subscribing to the Everest Formula.

Don't miss new Blog Posts in your email

1. Paypal Holdings – PYPL

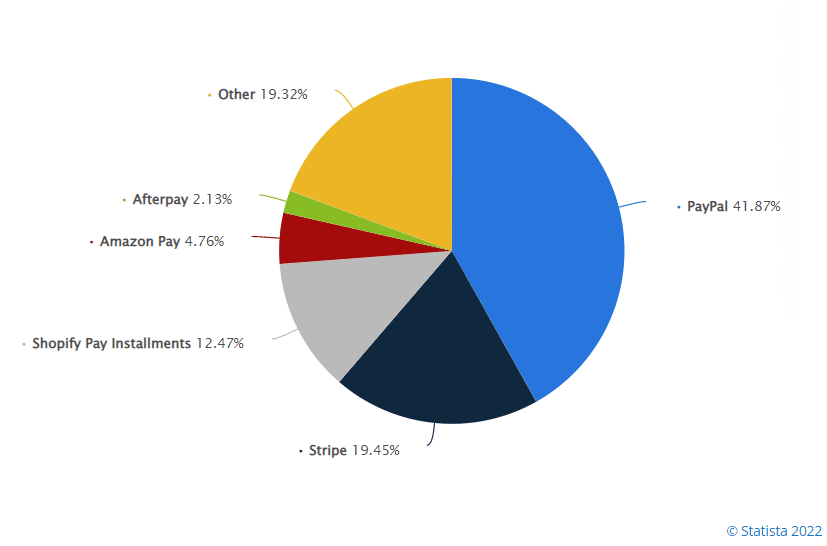

PayPal is one of the most popular platforms for digital payments that allows consumers to send and receive payments in approximately 200 markets and approximately 100 currencies. It is the leading actor in the online payment market, with a 40% share of worldwide transactions:

The slowing of sales growth and the weak guidance that the management has pointed out for the next quarters are the main contributors to the massive drawdown of the last two years, in which Paypal has lost more than 70% of its capitalization:

Investment Tesis

- Paypal has built a solid MOAT over the years due to its platform’s network effect, which counts over 400 million users.

- While the growth of active accounts is slowing down, the number of payment transactions increased with a solid pace – 15.2% YoY growth to 5,643 million.

- PayPal is undertaking promising partnerships with Apple and Amazon. Together with its “Buy Now, Pay Later” initiative, the prospects for reviving its revenue growth are more than concrete.

Risks

- Even after a 70% drop, the stock is still at a P/E of 37 and an FCF/EV of less than 7. This means that at the peak of its valuation, the stock was highly overvalued and that we may not have seen the bottom yet, especially if the growth continues to slow down.

- The macroeconomic environment and the probable 2023 recession could soften consumer e-commerce spending, resulting in a prolonged growth slowdown and an additional stock valuation shrink.

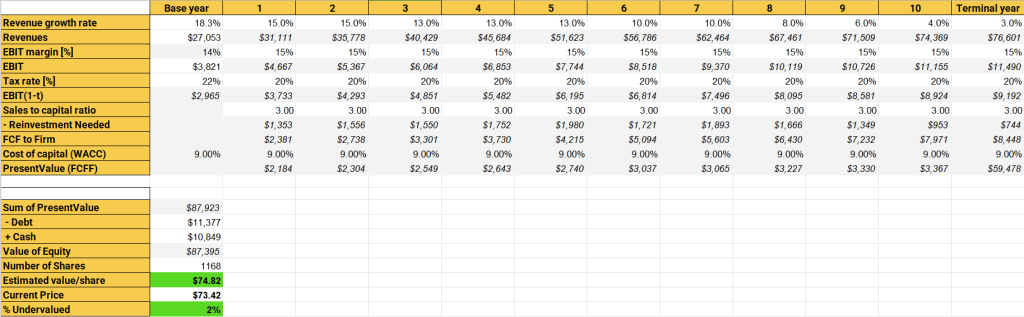

Valuation

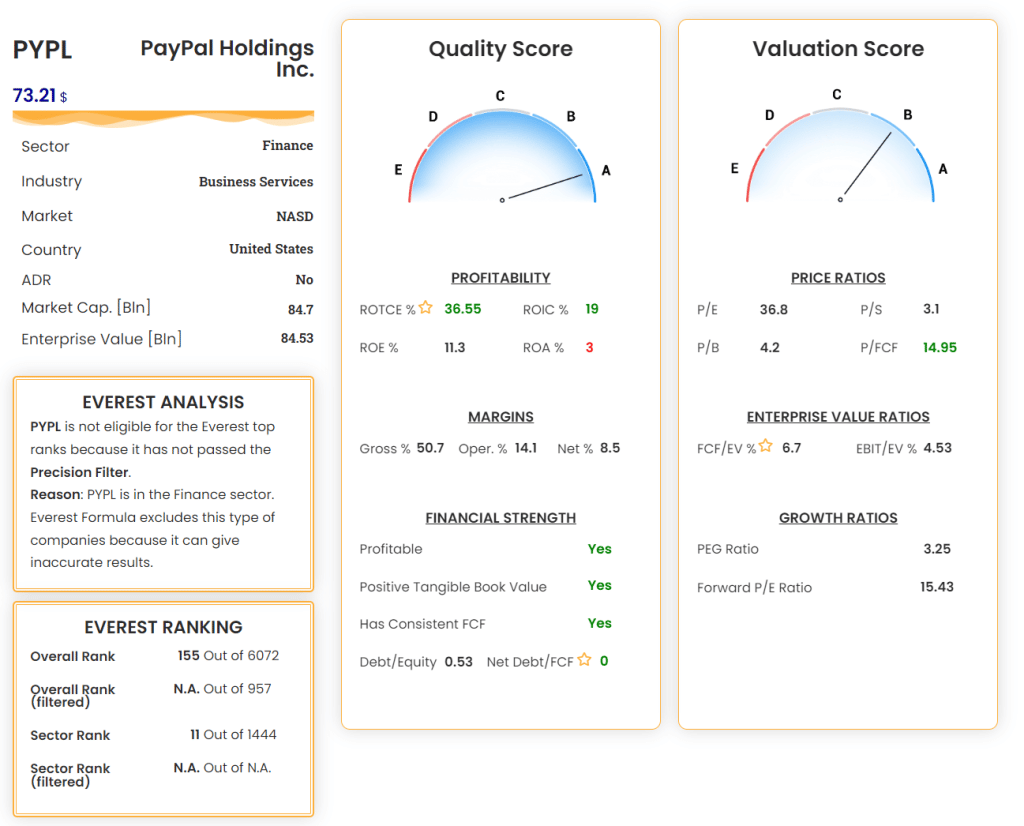

The Everest Analyzer gives Paypal stock a perfect quality score of A. The quality metrics confirm the high profitability and the big MOAT of the business, with the management able to obtain good margins with low debt.

From a valuation perspective, the score is B. As mentioned before, Paypal has now started to look attractive, even if the stock could fall further given the extreme overvaluation in which the stock was at its valuation peak.

We also extracted an intrinsic stock valuation using a discounted cash flow model and a mix of inputs from analysts’ estimates and historical data. The result shows that the stock now seems reasonably priced, with an intrinsic valuation of 74.82$, compared to the current price of 74.42$. The stock is already appealing for a first buy, but we would like a further 10-15% drop before considering it an undervalued stock and consistently entering it.

What is certain is that PayPal is one of the best companies to monitor for 2023 because of the unique buying opportunity that is coming up.

2. Google (Alphabet) – GOOGL

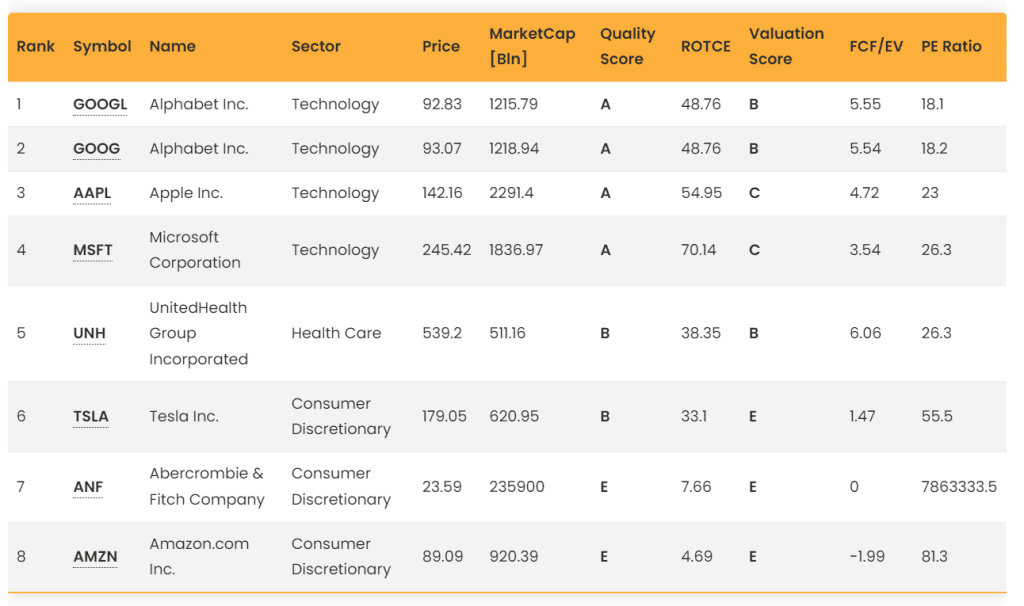

The following two stocks come directly from the Everest Screener, configured to find the most undervalued stocks among big caps:

The first one is Alphabet, for which we already did a complete analysis some months ago, which you can read here. From that point, the stock has lost about 13%, with no fundamental changes in its business, for which we believe that now investors have a unique opportunity to buy a fantastic company at a low price for the long term.

Overview

Google has been one of the most important companies in the technology sector over the past 20 years. Most revenue comes from advertising on the Google search engine, YouTube and partner sites. Moreover, Google is expanding its revenues in other areas, such as hardware sales (Fitbit), cloud computing (Google Cloud), subscriptions (Youtube Premium), and other bets.

Compounded by a generally bearish market, the stock has lost almost 40% since the end of last year. Indeed, the current macroeconomic scenario of a possible recession and hyperinflation points to a potential slowdown in advertising demand and sales from the massive growth it has had in the past years.

Investment Tesis

Google is one of the companies with the biggest MOAT in the world. It is challenging to imagine a world without Google’s services ten years from now. It has built world-class advertising technologies for its customers to run their digital marketing businesses. Google’s competitive advantages continue to grow through data collection, allowing the company to provide the right ad at the right time.

Risks

Alphabet’s management expects several obstacles to slow growth, if not decrease earnings in the coming months, including:

- Possible slowdown in advertising demand due to the inflationary environment that causes spending reviews and less money circulation.

- Foreign exchange rate, with the strong dollar being a headwind due to worldwide sales as opposed to research and development spending that is primarily U.S.-based

- The pandemic has enhanced growth in the past two years, which has increased the use of Alphabet’s services. However, 2022 will inevitably see a slowdown in growth.

- Possible legislative hurdles: The U.S. Senate and the European Community have initiated tough new legislative efforts to counter Alphabet’s “unfair market dominance.”

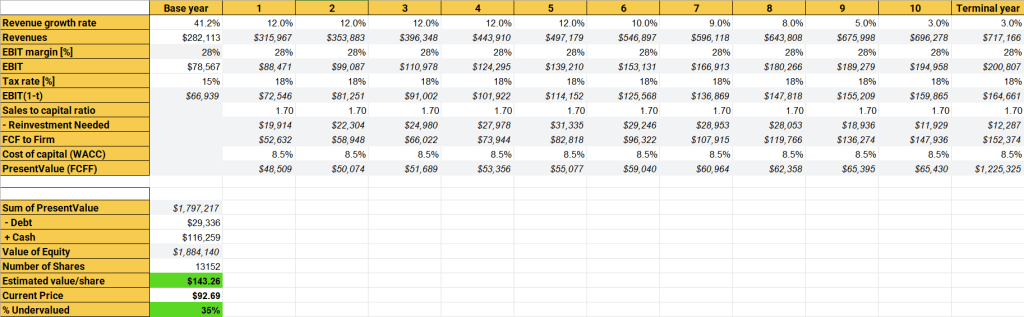

Valuation

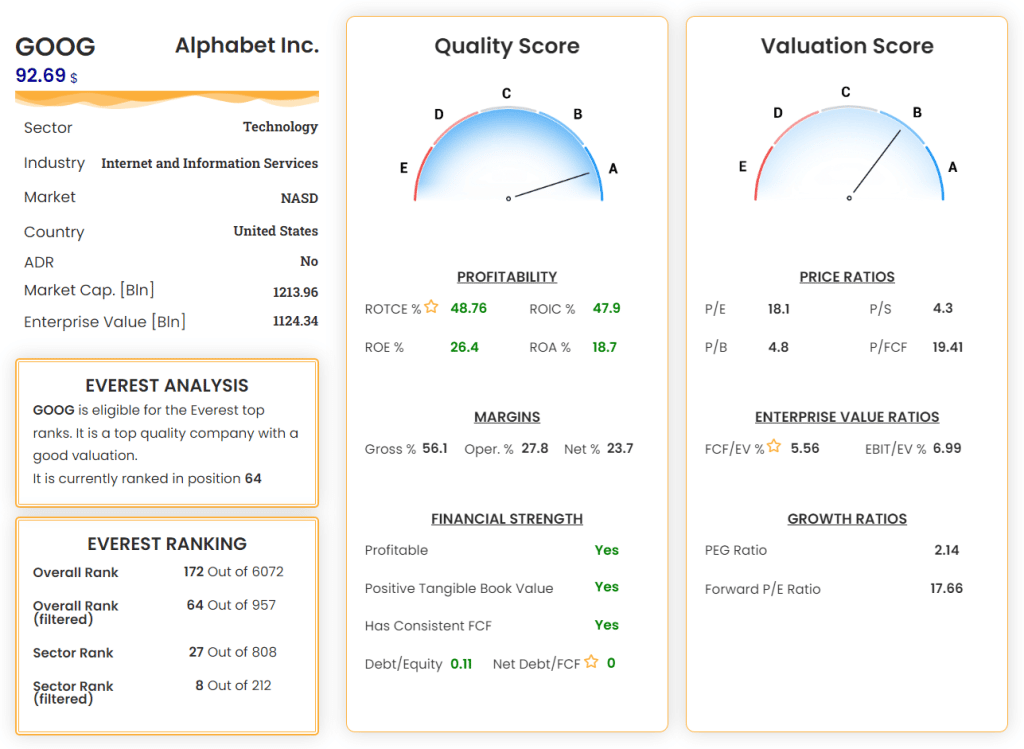

The Everest Analyzer gives Alphabet stock a quality score of A. There’s no surprise that Google is one of the best companies from a quality perspective.

From a valuation perspective, the Analyzer gives a score of B, an increase from the “C” score of some months ago. The P/E of 18 is well below the average historical valuation and tech sector. Google now looks really attractive from a quantitative point of view.

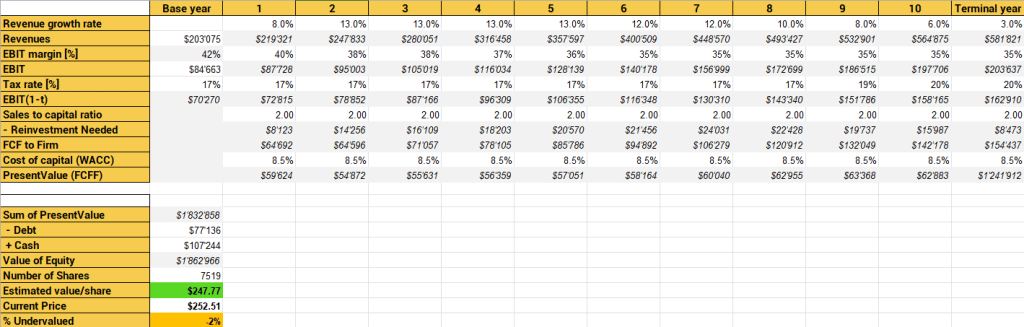

We have updated the DCF with the last earning report and slowing down the expected future growth from 14% to 12%, according to the most recent analyst’s estimates.

The result is that the stock is currently 35% undervalued, with an intrinsic value of 143.26$, well above the current price of 92.83$. GOOGL is definitely a high-quality, undervalued stock to buy now for the long term.

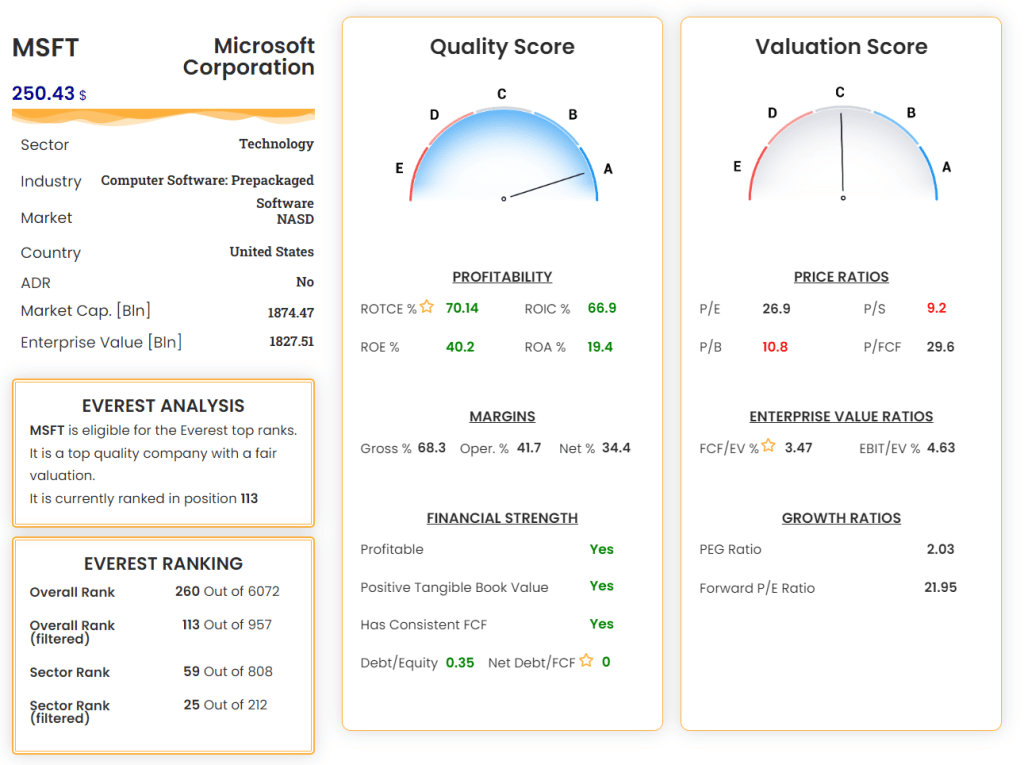

3. Microsoft Corp. – MSFT

Microsoft is the second stock we want to highlight among the best high-capitalization companies according to the Everest Screener. MSFT is a perfect example of a high-quality business that can compound its value over the long term. The company is the sum of three businesses:

- Productivity and Business Processes provide Office 365 applications such as Word, Excel, etc. Its products and services have become digital necessities in daily life and work and, as a result, generate stable cash flows.

- Intelligent Cloud provides public cloud services and is responsible for the company’s future growth.

- Personal Computing operates through Windows and Xbox products.

Investment Tesis

- Microsoft has a remarkable ability to generate cash flows due to its significant market share in the PC OS market and potential for future growth in the gaming industry.

- The three businesses of the company are not separate; they’re all closely interrelated and connected. This synergy is the fuel for future growth.

- MSFT is in a unique position to take advantage of network effects. Millions of people currently use the ecosystem Microsoft created for working and gaming, and it is difficult to leave if everyone else uses it.

Risks

- Microsft is currently down 26% from its peak, registered on November 2021. In a recession scenario, as we are likely to be in 2023, the stock could fall further. Indeed, looking at the last recessions, Microsoft’s share price dropped 59% during the Global Financial Crisis and 66% during the dot.com bubble burst.

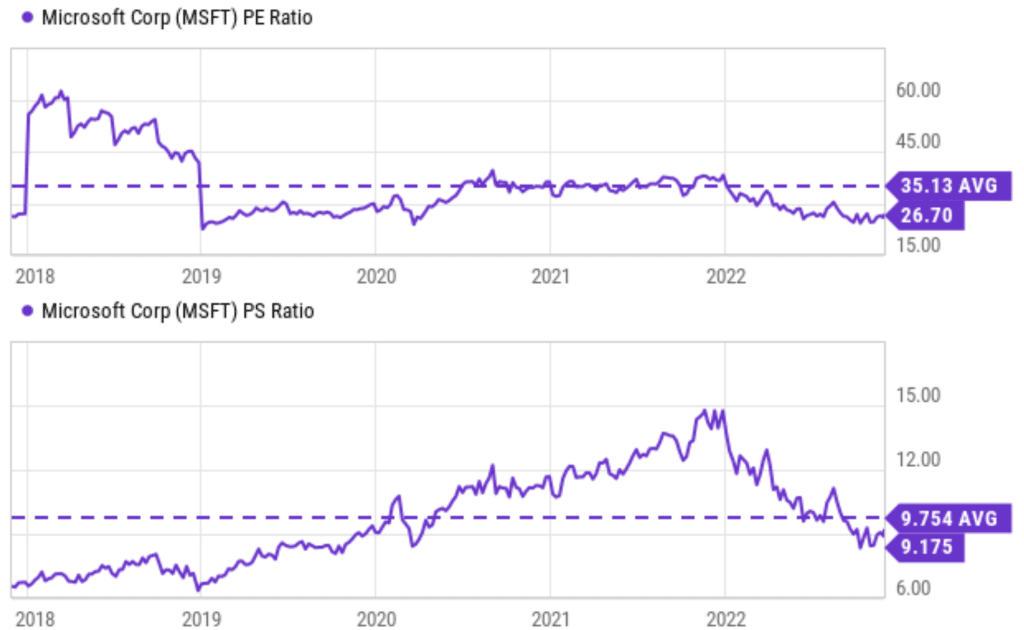

- Even looking at the valuation metrics, the stock seems not yet undervalued. With a P/E of 27 and a P/S of 9, the stock’s multiples are just a little below the average of the last five years (see the chart below), in which we need to consider that the stock was highly overvalued (e.g., PS multiple peaked at 15x).

Valuation

As we said, Microsoft is a high-quality company with remarkable profitability and an excellent management team. So there’s no surprise that the Everest Formula assigns a quality score of A.

From the valuation side, the score is C (fairly valued). As outlined in the risks section, the stock doesn’t seem undervalued, and we would like a further drop to buy it.

The discounted cash flow confirms the valuation score of the Everest Analyzer: the current price approximately matches the intrinsic value, extracted using as input of the model a mix of analysts’ estimates and historical averages. Under 200$, it would become one of the best opportunities in the stock market.

Microsoft is already a good investment, given that it is a great business at a fair price, but 2023 could bring a unique opportunity to acquire one of the best companies to keep for the long term if its price drops at least another 15-20%.

4. Micron Technology – MU

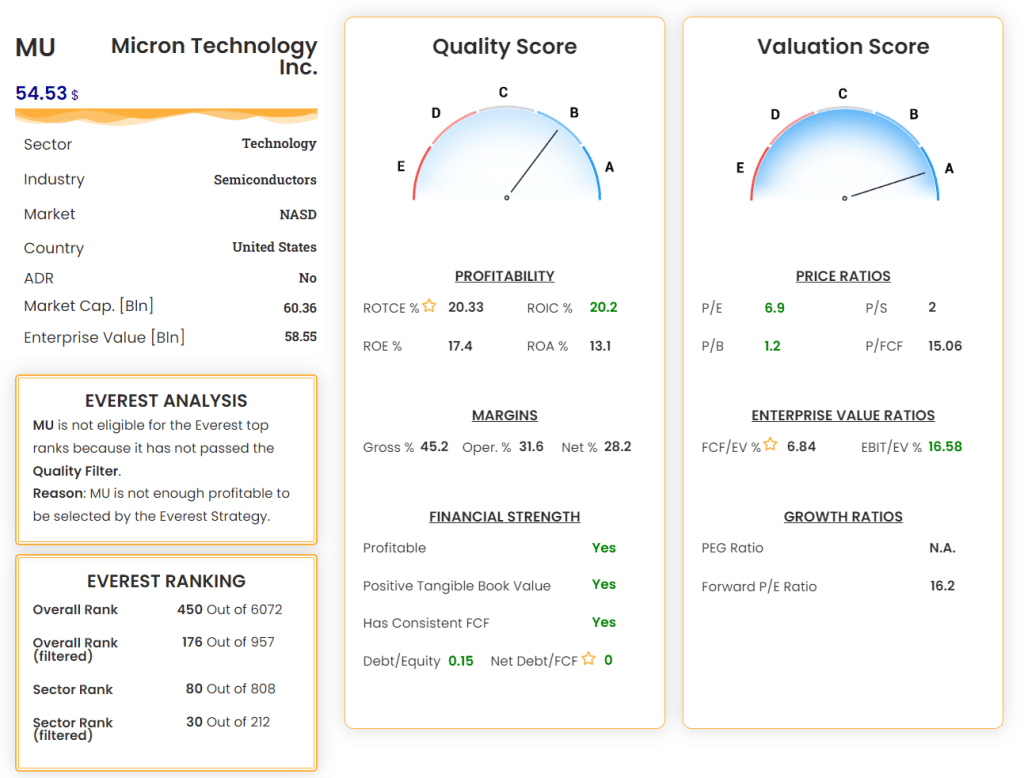

We already covered MU with a complete analysis in a recent blog post that you can read here.

In the article, we conclude our analysis with the following sentence:

“Given our calculations and the current price of 61.78$, the stock seems 8% undervalued. But given the uncertain nature of estimates and the need to have an adequate margin of safety before buying a stock, we would prefer an undervaluation of at least 20% before considering Micron a buy. So our buy price is currently $53.57.”

Compared to a month ago, nothing has changed from a valuation point of view, and the price has dropped 10% to 54.53$. We are near our buy price, so investors should closely follow this great company that has attracted the attention of super investors like Mohnish Pabrai, Li Lu, Guy Spier and Seth Klarman.

5. Builders First Resource Inc. – BLDR

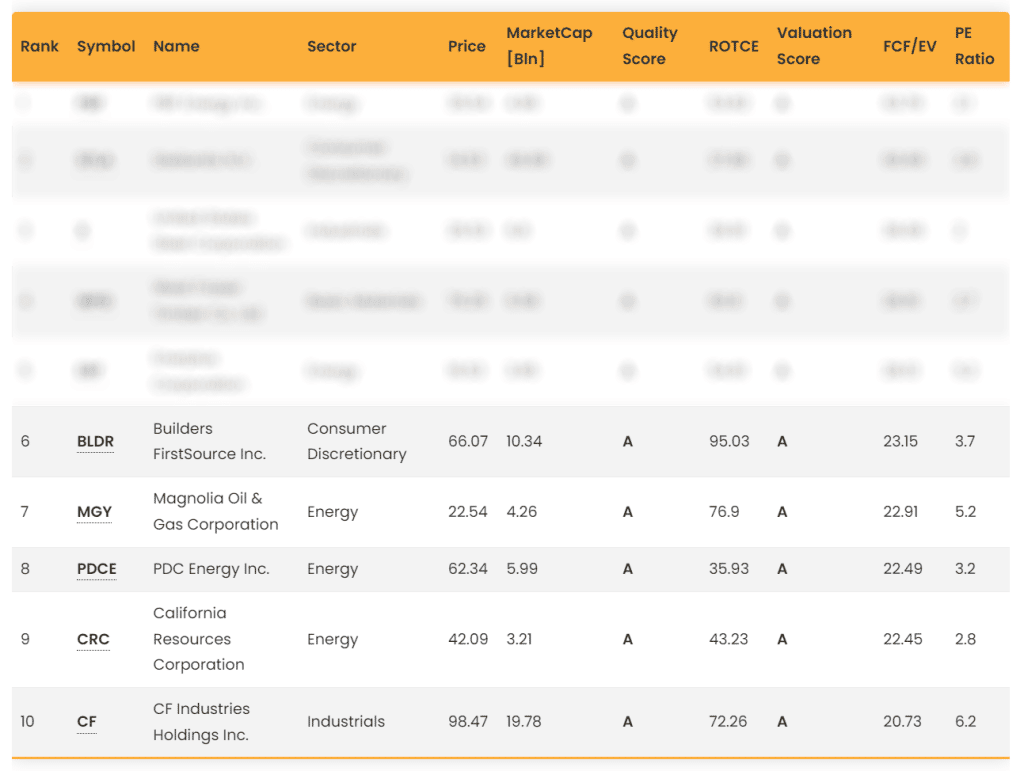

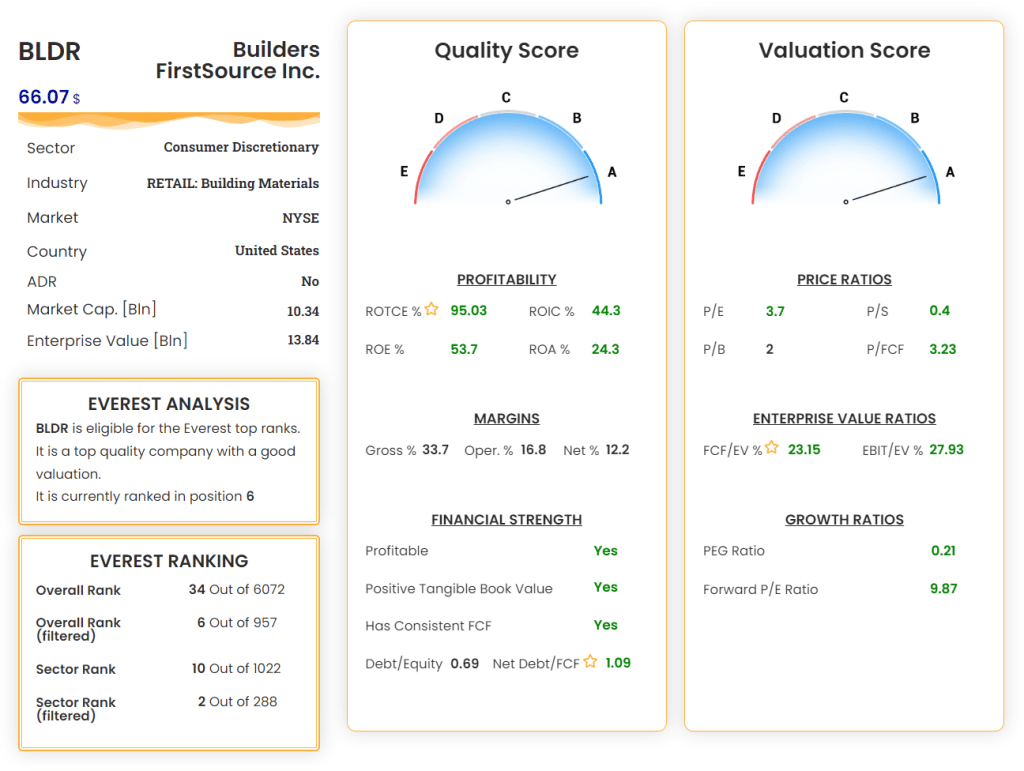

The last stock to watch for 2023 comes directly from the top 10 stocks of the Everest Formula: BLDR, which is currently in the 6th position of the global rank.

Builders FirstSource, Inc. manufactures and supplies building materials, manufactured components, and construction services to professional homebuilders, sub-contractors, remodelers, and consumers in the United States since 1998. In addition, the company continues to invest in growth through strategic acquisitions, thereby gaining market share and growing faster than the market. Indeed, the company has grown more than 38% annually over the last ten years.

Investment Tesis

- The housing market will probably survive without crashing in the current recessionary environment. Hence, no panic situation is expected that could significantly cause a downturn in the company’s performance. On the contrary, BLDR’s operating performance is producing solid results, and its current attractive valuation supports a buy rating for the stock.

- The company has wisely reinvested profits into a diversified portfolio of acquisitions and reduced its debt, lowering its overall exposure to a construction recession.

Risks

- Builders FirstSource is highly dependent on macroeconomic conditions. Actual construction spending peaked in mid-2021 and has declined considerably since. If the trend continues, the stock will likely climb down, even if the long-term prospects are still thriving.

- This sector is highly cyclical and volatile. Buying this kind of stock at the cycle’s peak or the wrong moment could lead to negative returns for investors for years.

Valuation

BLDR is a fast-growing company with outstanding profitability (ROTCE of 95%, ROIC of 44%), good operative margins and low debt. These characteristics are combined with bankruptcy company valuations (P/E of 3.7, FCF/EV of 23%). So, it should come as no surprise that it has a perfect A score in both quality and valuation, and is currently one of the best companies recommended by Everest Formula.

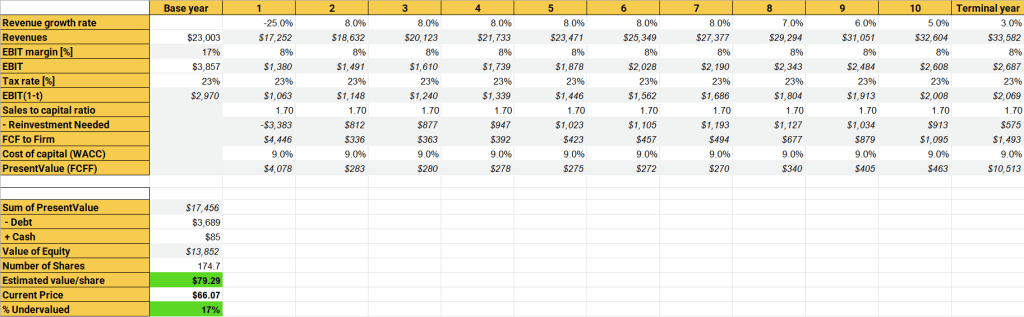

We simulate through the DCF model a realistic scenario in which the revenue will significantly drop in 2023 after the boom of the last two years and then a steady 8% growth for the following years, according to analysts and the historical average. The result is that the stock is 17% undervalued, with a target price of 79.29$.

BLDR is one of the top undervalued stocks to own right now.

Top stocks to buy – Conclusions

We have identified the best stocks to buy and watch for 2023, thanks to the Everest Formula which allows us to identify the most undervalued stocks of the moment.

The Everest Strategy is a strategy that has returned more than 30 percent annually on average over the past 22 years. If you are interested in applying it to your portfolio, subscribe now.